Navigating your "elderly parent's finances" can be a challenging yet crucial task. As they age, understanding their "financial situation", including assets, debts, and planning for future needs, becomes increasingly important. This article will guide you through ten essential things you should know to ensure their financial well-being and security.

1. "Assess Their Financial Situation"

Start by gathering all necessary information about your parent's "income", including pensions, Social Security benefits, and any other sources of revenue. Additionally, review their "expenses" like housing, healthcare, and daily living costs to understand their overall financial health.

2. "Understand Their Assets"

Take inventory of your parent's "assets". This includes properties, bank accounts, investments, and any valuable personal items. Knowing what they own can help in planning for future care or potential expenses.

3. "Identify Debts and Liabilities"

It's equally important to be aware of any debts your parents may have, such as mortgages, credit cards, or loans. Understanding their "liabilities" will help you manage their financial obligations more effectively.

4. "Review Their Budget"

Create a budget that reflects your parent's income and expenses. This will help identify any areas where they may need to cut back or where additional income might be necessary. A clear view of their "financial landscape" is essential for making informed decisions.

5. "Plan for Healthcare Costs"

Healthcare can be one of the most significant expenses for elderly individuals. Familiarize yourself with their "health insurance" coverage, including Medicare or any supplemental plans. Understanding these costs can help prevent financial strain due to unexpected medical bills.

6. "Understand Their Estate Plan"

Discuss your parent's "estate planning" documents, such as wills and trusts. Knowing their wishes regarding inheritance and asset distribution can prevent potential family disputes and ensure that their desires are honored.

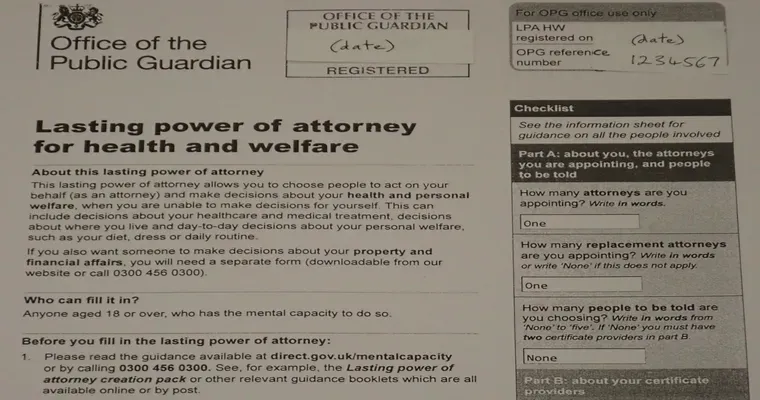

7. "Power of Attorney"

Establish whether your parent has designated a "power of attorney". This legal document allows someone to make financial decisions on their behalf if they become unable to do so. Ensure that the appointed person is trustworthy and understands your parent's wishes.

8. "Review Beneficiary Designations"

Check all accounts and policies for "beneficiary designations". Ensuring that these are up-to-date and reflect your parent's current wishes is crucial for the smooth transfer of assets after their passing.

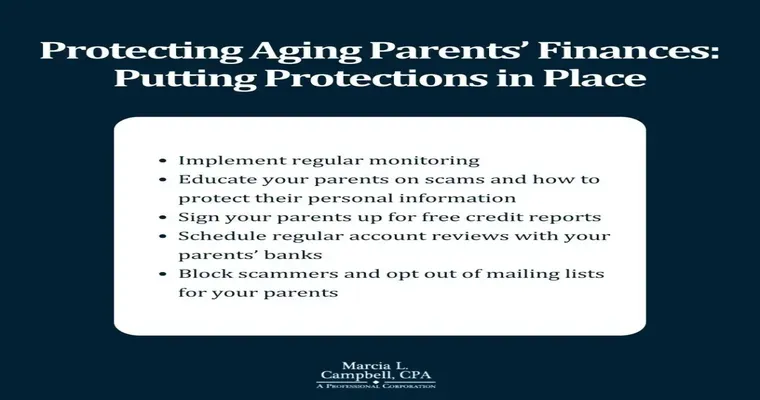

9. "Protect Against Financial Scams"

Educate your parents about the risks of "financial scams" that target the elderly. Help them recognize common tactics used by fraudsters, such as phishing emails or phone scams, and encourage them to be cautious about sharing personal information.

10. "Seek Professional Help if Necessary"

If managing your parent's finances becomes overwhelming, consider seeking help from a financial advisor or elder law attorney. These professionals can provide valuable guidance on "financial planning", tax strategies, and legal matters related to aging.

By understanding these ten key aspects of your elderly parent's finances, you can help ensure their financial stability and make informed decisions that promote their well-being in later years. Taking proactive steps can ease the burden on both you and your parents as they navigate this important phase of life.