Creating an "end of life plan" is a crucial step that everyone should consider. This process involves making decisions about how you want to be cared for in your final days, addressing important issues such as "advanced directives", funeral arrangements, and the distribution of your "assets". Taking the time to outline your preferences not only eases the burden on your loved ones but also ensures that your wishes are respected.

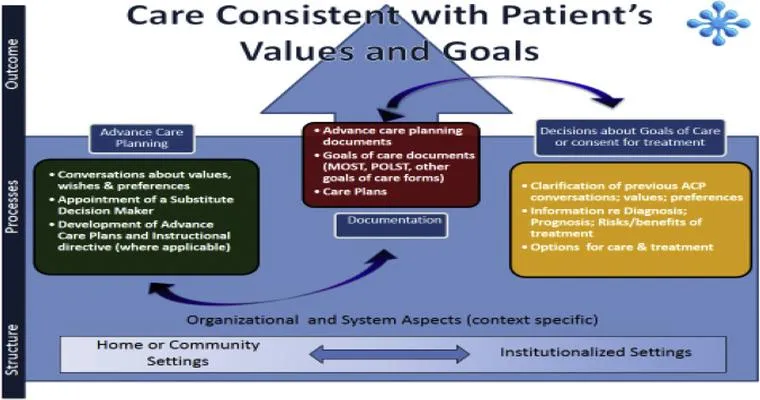

When embarking on the journey of deciding on an end of life plan, it's essential to understand the various components involved. One of the first steps is to consider your "healthcare preferences". This includes determining who will make medical decisions on your behalf if you are unable to do so. An "advance directive", also known as a living will, allows you to express your wishes regarding medical treatments and interventions. It’s wise to discuss your choices with your family and healthcare providers to ensure everyone is on the same page.

Another important aspect of an end of life plan is making arrangements for your "funeral" and memorial services. This includes choosing between burial or cremation, selecting a location for the service, and deciding on any specific readings or music that you would like to be included. Pre-planning your funeral can relieve your family of the emotional and financial stress associated with these decisions at a time of grief.

In addition to healthcare and funeral arrangements, addressing the distribution of your "assets" is a vital part of your end of life planning. Establishing a "will" or a "trust" will help ensure that your belongings are distributed according to your wishes. You should also consider naming an "executor" who will be responsible for managing your estate and ensuring that your directives are followed.

It is also advisable to review your "insurance policies" and any other financial matters that may impact your end of life plan. Understanding your life insurance, health insurance, and any long-term care insurance can provide peace of mind and help you make informed decisions.

Lastly, keep in mind that your end of life plan is not set in stone. It is important to revisit and update your plan periodically, especially after major life changes such as marriage, divorce, or the birth of a child.

In conclusion, deciding on an end of life plan is an empowering process that allows you to take control of your future. By addressing your healthcare preferences, funeral arrangements, asset distribution, and financial matters, you can create a comprehensive plan that reflects your wishes. This proactive approach not only alleviates stress for your loved ones but also gives you peace of mind knowing that your desires will be honored.