Navigating the complexities of "Medicare coverage" can be challenging for many individuals. Understanding what "costs" are covered by Medicare is crucial for seniors and those with disabilities who rely on this federal health insurance program. In this article, we will explore the various parts of Medicare, what they cover, and how you can manage your healthcare expenses effectively.

Medicare is divided into different parts: "Part A", "Part B", "Part C", and "Part D". Each part addresses different aspects of healthcare services, and knowing what each part covers can help you determine your out-of-pocket expenses.

"Part A", often referred to as hospital insurance, typically covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services. Most people do not pay a premium for "Part A" if they or their spouse paid Medicare taxes for a certain amount of time while working. However, there are deductibles and coinsurance that may apply, which could impact your overall healthcare "costs".

"Part B", or medical insurance, covers outpatient care, doctor visits, preventive services, and some home health care. Unlike "Part A", "Part B" requires a monthly premium, which can vary based on your income. It also has an annual deductible, and you will generally be responsible for 20% of the Medicare-approved amount for most services after the deductible is met.

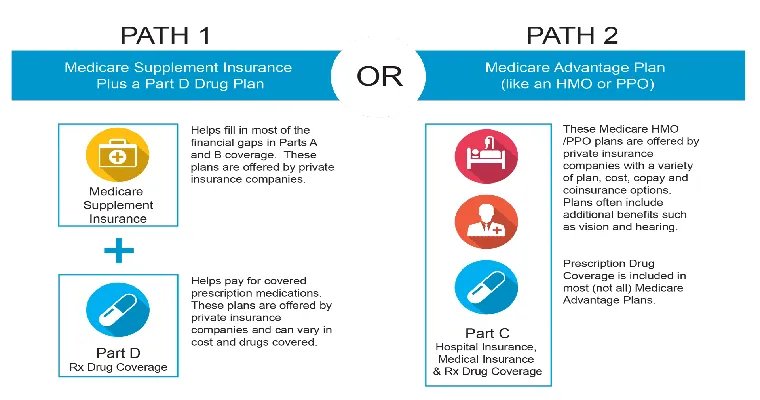

"Part C", known as Medicare Advantage, is an alternative to Original Medicare (Parts A and B). Medicare Advantage plans are offered by private insurance companies and typically include additional benefits like vision and dental coverage. These plans may have different costs and coverage options, so it is essential to review the specifics of each plan to understand how they fit your needs.

Finally, "Part D" provides prescription drug coverage. This part is also offered through private insurance companies and requires a separate premium. It is crucial to enroll in a "Part D" plan to help cover the costs of medications, as Original Medicare does not include this coverage.

In addition to understanding the different parts of Medicare, it's important to know about "Medicare Supplement Insurance", or Medigap. These policies are designed to help cover costs not fully paid by Medicare, such as copayments, coinsurance, and deductibles. Depending on the plan you choose, Medigap can significantly reduce your out-of-pocket expenses.

To determine whether Medicare covers your specific "costs", you can use the Medicare website or contact your local Medicare office for assistance. They can provide personalized information based on your health needs and financial situation.

In conclusion, "Medicare" offers comprehensive coverage for many healthcare services, but understanding the details of what is covered and what costs you may incur is essential for effective financial planning. By familiarizing yourself with the different parts of Medicare and considering additional coverage options, you can make informed decisions about your healthcare and manage your expenses effectively.