Navigating the world of "skilled nursing" and "Medicare Advantage Plans" can be complex, but having a solid "game plan" can simplify the process. Understanding how these plans work and what they cover is essential for individuals seeking quality care. Skilled nursing facilities provide necessary rehabilitation and medical services for patients recovering from illness or surgery, and Medicare Advantage Plans often include benefits that can help ease the financial burden of these services.

Understanding Medicare Advantage Plans

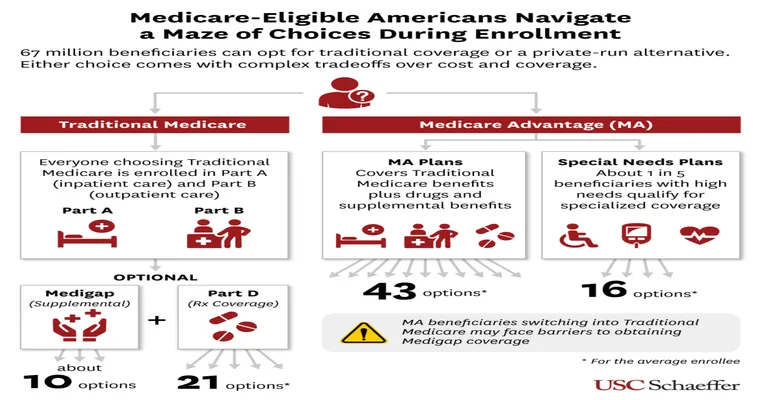

Medicare Advantage Plans, also known as Part C, are offered by private insurance companies that contract with Medicare to provide all your Part A and Part B benefits. Many of these plans also include additional benefits such as dental, vision, and hearing coverage, which traditional Medicare does not cover. When considering skilled nursing care, it is crucial to review the specific plan details, as coverage can vary significantly between plans.

Coverage for Skilled Nursing Care

One of the main advantages of Medicare Advantage Plans is their coverage for skilled nursing facilities. To qualify for these benefits, patients typically need to have a three-day hospital stay before being admitted to a skilled nursing facility. Once admitted, Medicare covers up to 100 days of care in a skilled nursing facility, with the first 20 days fully covered, and a daily co-payment for days 21-100.

It is important to note that not all Medicare Advantage Plans cover skilled nursing care equally. Some plans may have specific networks of facilities or additional out-of-pocket costs. Always check the plan’s Summary of Benefits to understand the specifics of your coverage.

Choosing the Right Skilled Nursing Facility

When it comes to selecting a skilled nursing facility, consider the following factors:

1. "Location": Proximity to family and friends can make a significant difference in the recovery process.

2. "Quality Ratings": Use tools such as the Nursing Home Compare website to assess quality ratings and reviews of different facilities.

3. "Services Offered": Ensure the facility provides the level of care needed for recovery, including physical therapy and other rehabilitation services.

4. "Medicare Contract": Confirm that the facility accepts your specific Medicare Advantage Plan to avoid unexpected costs.

Understanding Out-of-Pocket Costs

While Medicare Advantage Plans often cover a significant portion of skilled nursing care, it is essential to understand any out-of-pocket costs you may incur. This can include co-payments for services, deductibles, and any non-covered services. Always review your plan’s cost-sharing structure to prepare for any potential expenses.

Communicating with Healthcare Providers

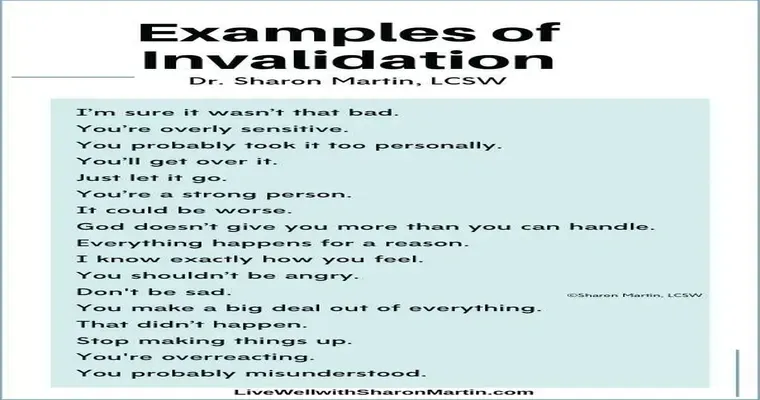

Effective communication with healthcare providers is vital in managing skilled nursing care. Ensure that your primary care physician and the skilled nursing facility staff are aware of your Medicare Advantage Plan details. This will help facilitate smooth transitions between hospital and skilled nursing care and ensure that all necessary services are covered.

Conclusion

Creating a "game plan" for skilled nursing with a "Medicare Advantage Plan" involves understanding the coverage options available, selecting the right facility, and communicating effectively with healthcare providers. By taking these steps, patients can ensure they receive the necessary care without facing overwhelming costs. Always keep abreast of any changes in your plan or coverage to make informed decisions about your healthcare needs.