Taking on the "responsibility of caregiving" can be both rewarding and challenging. However, many individuals find that their "caregiving duties" have negatively impacted their "finances". From the costs associated with providing care to the potential loss of income due to reduced work hours, the financial strain can be significant. In this article, we will explore the various ways caregiving can affect your financial situation and provide tips on managing those challenges.

One of the most immediate financial impacts of caregiving is the "out-of-pocket expenses" that can accumulate quickly. Whether it’s purchasing medical supplies, medications, or home modifications to improve accessibility, these costs can add up. Additionally, caregivers often bear the burden of transportation expenses for medical appointments or other necessary outings. It is crucial to keep track of these expenses, as some may be tax-deductible, providing a small relief in your overall financial load.

Another aspect to consider is the "loss of income" that many caregivers experience. Balancing a job while providing care can be incredibly challenging. Some caregivers may need to reduce their working hours or even leave their jobs altogether, leading to a significant decrease in household income. This loss can affect not only immediate financial stability but also long-term savings and retirement plans. It is essential to evaluate your current work situation and explore options such as flexible work arrangements or remote work opportunities that can accommodate your caregiving responsibilities.

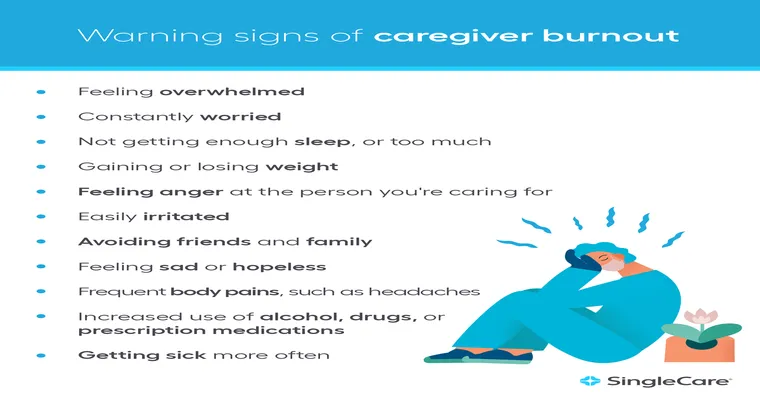

Moreover, the emotional and physical toll of caregiving can lead to additional costs related to "healthcare". Caregivers often neglect their own health, leading to increased medical expenses down the line. Chronic stress, anxiety, and depression are common among caregivers, and the need for therapy or medical treatment can further strain finances. Prioritizing self-care is vital not only for your well-being but also for your ability to provide quality care to your loved one.

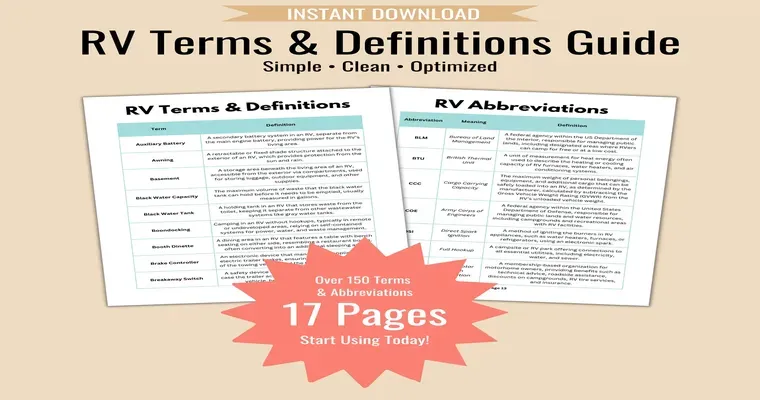

In light of these challenges, seeking financial assistance or resources can be beneficial. Many organizations offer grants or aid specifically for caregivers, which can help alleviate some of the financial burden. Additionally, looking into "state and federal programs" that provide support for caregivers can be advantageous. Understanding your rights and available resources can empower you to navigate this complex situation more effectively.

To mitigate the financial impact of caregiving, it is essential to create a detailed budget that accounts for both your caregiving expenses and your personal finances. This budget should include all monthly expenses, potential income losses, and any additional costs that may arise from your caregiving role. By having a clear picture of your financial situation, you can make informed decisions about how to allocate your resources and identify areas where you may need to cut back.

In conclusion, while the role of a caregiver can bring immense fulfillment, it is crucial to recognize the potential negative impacts on your finances. By taking proactive steps to manage expenses, seeking financial assistance, and prioritizing your own health, you can find a balance that allows you to care for your loved ones without sacrificing your financial future. Remember, taking care of yourself is just as important as taking care of others.