In today's fast-paced world, it is crucial to regularly "review your financial beneficiaries" and "co-signers". These important decisions can significantly impact your financial future and the distribution of your assets. Whether you are planning for retirement, updating your estate plan, or simply managing your finances, ensuring that your beneficiaries and co-signers are up to date can help you avoid complications down the road.

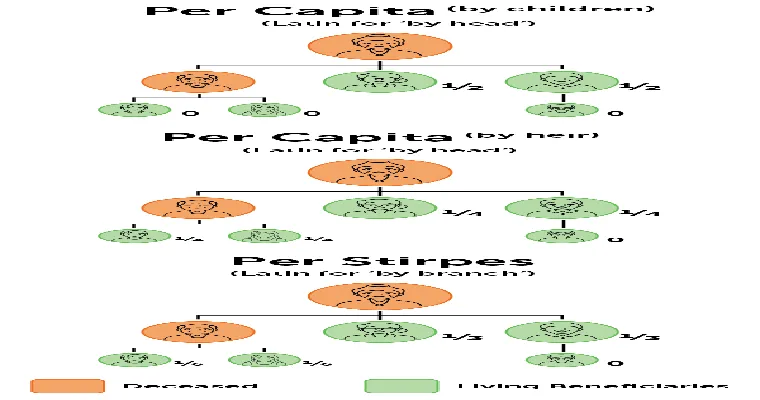

Understanding the roles of beneficiaries and co-signers is essential. Beneficiaries are the individuals or entities designated to receive your assets upon your passing. This can include life insurance policies, retirement accounts, and trusts. Co-signers, on the other hand, are individuals who agree to share responsibility for a loan or financial obligation, which can affect your credit and financial standing.

One of the primary reasons to review your financial beneficiaries is to ensure that your wishes are accurately reflected. Life circumstances change; marriages, divorces, births, and deaths can all impact who you want to inherit your assets. Failing to update your beneficiaries can lead to unintended consequences, such as estranged family members receiving your assets or loved ones being left out entirely.

Similarly, reviewing your co-signers is vital, especially if your financial situation has changed. If you co-signed a loan for a friend or family member and your relationship has since soured, you may want to reconsider that commitment. Additionally, if your co-signer’s financial situation has changed—such as a new job, increased debt, or credit issues—you might want to reassess whether they are still a good fit for your financial agreements.

Another aspect to consider when evaluating your beneficiaries and co-signers is the potential tax implications. Certain beneficiaries may be subject to different tax treatments, affecting the net amount they receive. Furthermore, having a co-signer with a poor credit history can negatively impact your own financial health, possibly resulting in higher interest rates or loan denials.

To make this process easier, set a regular schedule to review your financial documents. This could be annually or after any significant life event. During this review, take the time to assess not only the names of your beneficiaries and co-signers but also their contact information and the specific assets or debts they are associated with.

In conclusion, taking the time to "review your financial beneficiaries" and "co-signers" is an essential part of effective financial planning. It ensures that your assets are distributed according to your wishes and protects your financial interests. By staying proactive and making necessary updates, you can safeguard your legacy and provide peace of mind for yourself and your loved ones. Make it a priority to assess these critical elements regularly, and you'll be better prepared for whatever life may bring.