In today's digital age, being alert to potential "scammers" is crucial for protecting your personal information and finances. With increasing reports of fraudulent activities online, it is essential to stay informed about common tactics used by these "scammers". This article aims to provide you with insights into how to recognize a "scammer" and the steps you can take to safeguard yourself from their deceptive practices.

One of the most common methods employed by "scammers" is phishing. This involves sending emails or messages that appear to be from legitimate sources, such as banks or well-known companies, asking for sensitive information. Always verify the sender's email address and be wary of generic greetings or urgent requests for personal data. Legitimate organizations typically do not ask for sensitive information via email.

Another tactic is the use of fake websites. "Scammers" create websites that mimic those of reputable businesses to trick users into providing their details. Before engaging with a site, check for secure connections (look for "https" in the URL) and read reviews from other users. If a deal seems too good to be true, it probably is.

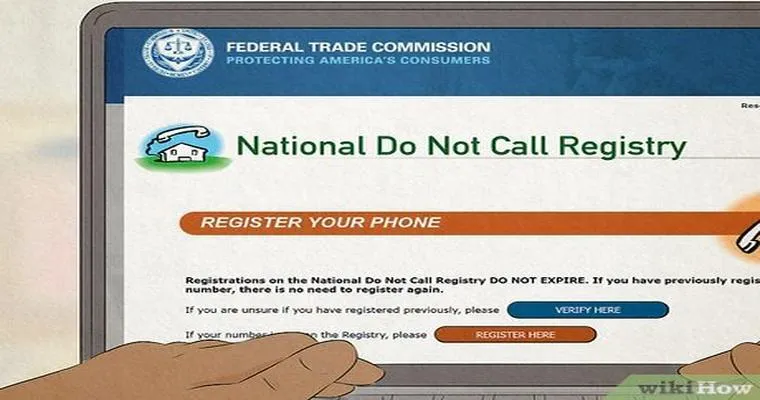

Phone scams are also on the rise, where "scammers" pose as representatives from government agencies or service providers. They may threaten you with legal action or claim that your account has been compromised. Always hang up and call the official number of the organization in question to confirm any claims made.

Social media platforms are not exempt from "scammers". Be cautious of friend requests from unknown individuals and avoid sharing personal information publicly. "Scammers" often use social engineering tactics to exploit your trust and gain access to your accounts.

If you believe you have encountered a "scammer", report the incident to the appropriate authorities. In the United States, you can report fraud to the Federal Trade Commission (FTC) or your local consumer protection agency. Taking action helps protect others from falling victim to similar scams.

In conclusion, staying vigilant and informed is your best defense against "scammers". By recognizing the signs of fraudulent behavior and taking proactive measures, you can protect yourself and your financial well-being. Always remember to approach unsolicited communications with caution and trust your instincts. If something feels off, it probably is. Stay safe and secure in the digital world.