Medicare Advantage Plans, often referred to as "Medicare Part C", provide an alternative way for individuals to receive their "Medicare benefits". These plans are offered by private insurance companies and are designed to cover all the services that Original Medicare (Part A and Part B) covers. Additionally, many Medicare Advantage Plans include extra benefits such as "prescription drug coverage", dental care, vision care, and wellness programs. Understanding how these plans work can help beneficiaries make informed choices about their healthcare coverage.

Medicare Advantage Plans operate under the guidelines set by Medicare but are managed by private insurers. When you enroll in a Medicare Advantage Plan, you are still part of the Medicare program, but your coverage is provided through the plan instead of directly through Medicare. This means that the "Medicare Advantage Plan" will handle your claims and pay for your healthcare services.

One of the key features of Medicare Advantage Plans is that they often require members to use a network of doctors and hospitals. Many plans operate on a Health Maintenance Organization (HMO) or Preferred Provider Organization (PPO) basis, which means that seeing providers outside the network may result in higher out-of-pocket costs or no coverage at all. This emphasis on network providers is designed to keep healthcare costs down while ensuring that members receive coordinated care.

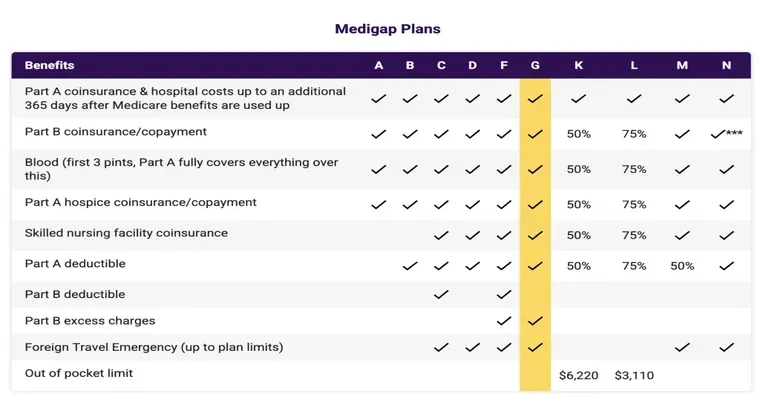

Another important aspect of Medicare Advantage Plans is their cost structure. Most plans have a monthly premium in addition to the standard Medicare Part B premium. Additionally, members may be responsible for copayments, coinsurance, and deductibles for various services. However, Medicare Advantage Plans are required to limit out-of-pocket expenses, providing a safeguard against exorbitant healthcare costs. This feature can be particularly beneficial for those who anticipate needing frequent medical care.

When selecting a Medicare Advantage Plan, beneficiaries should consider several factors, including coverage options, costs, provider networks, and additional benefits. It is crucial to compare different plans and assess how each one aligns with your healthcare needs and budget. Each year, beneficiaries have the opportunity to review and switch their plans during the "Annual Enrollment Period", allowing for adjustments based on changing health needs or financial situations.

In summary, Medicare Advantage Plans offer a comprehensive alternative to Original Medicare, providing additional benefits and services. By understanding how these plans work and what they offer, beneficiaries can make educated choices that best meet their healthcare needs. Whether you are new to Medicare or considering a change in your coverage, being informed about the workings of Medicare Advantage Plans can lead to better health outcomes and financial peace of mind.