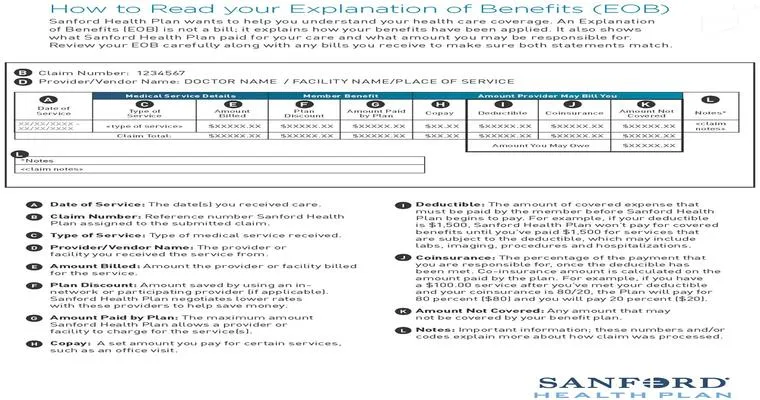

Understanding your "Explanation of Benefits (EOB)" statements is crucial for managing your healthcare expenses and ensuring that you are being billed correctly. An EOB is a document that your health insurance company sends you after you receive medical care. It outlines the services provided, the amount billed by the healthcare provider, and how much your insurance will cover. In this article, we will break down how to read these statements, what to look for, and tips to ensure you make the most of your healthcare benefits.

What is an Explanation of Benefits Statement?

An "Explanation of Benefits statement" serves as a summary of the healthcare services you received and the financial aspects associated with them. It is not a bill, but rather a breakdown of what your insurance plan covers and what you may owe. Understanding this document can help you track your medical expenses and avoid surprises when the actual bills arrive.

Key Sections of an EOB

1. "Patient Information": This section includes your name, policy number, and the date of service. It is essential to verify that the information is accurate.

2. "Provider Information": Here, you will find details about the healthcare provider or facility that treated you. This can help you confirm that you received care from an in-network provider, which often results in lower costs.

3. "Service Description": This outlines the specific services you received. Look for the codes associated with each service, as these can help you understand what was billed.

4. "Billed Amount": This is the total amount that the provider charged for the services rendered. It's important to compare this with what your insurance company has processed.

5. "Allowed Amount": This is the amount your insurance company has agreed to pay for the services based on your plan. If the billed amount is higher than the allowed amount, the provider cannot charge you the difference.

6. "Insurance Payment": This indicates how much your insurance company has paid for each service. This is a crucial figure as it directly affects your out-of-pocket costs.

7. "Patient Responsibility": This is the amount you are required to pay out of pocket, which may include copayments, deductibles, or coinsurance. Understanding this amount is vital for budgeting your healthcare expenses.

8. "Remarks": This section may contain important notes regarding your claim, such as reasons for denied claims or additional information needed.

Tips for Reading Your EOB

"Compare with Your Bills": Always compare your EOB with the bills you receive from your healthcare provider. This helps ensure that you are being charged correctly for the services rendered.

"Check for Errors": Mistakes can happen. If you notice discrepancies between the billed amount and the allowed amount, or if you believe you were charged for services you did not receive, contact your provider or insurance company for clarification.

"Understand Your Coverage": Familiarize yourself with your insurance plan's benefits, including deductibles, copayments, and out-of-pocket maximums. This knowledge will help you interpret your EOB more effectively.

"Keep Records": Maintain a file of your EOBs. This can help you track your healthcare expenses over time and provide documentation if disputes arise.

"Ask Questions": If you are unsure about any aspect of your EOB, do not hesitate to reach out to your insurance company or healthcare provider. They can provide clarification and assist you in understanding your statement.

Conclusion

Learning how to read "Explanation of Benefits statements" is essential for navigating the complexities of healthcare billing. By understanding the key components of your EOB, you can better manage your healthcare expenses, ensure accurate billing, and make informed decisions about your medical care. With the right knowledge and tools, you can empower yourself to take control of your health finances and maximize the benefits of your insurance plan.