Navigating the complex world of healthcare can be overwhelming, especially when it comes to understanding your "medical bills". Errors in "medical billing" can lead to higher "out-of-pocket expenses", causing significant financial strain. By learning how to spot these errors and take proactive steps, you can save money and ensure that you are only paying for the services you actually received.

Understanding Your Medical Bill

The first step in identifying "medical billing errors" is to thoroughly review your medical bill. Look for any discrepancies between the services listed on the bill and the services you actually received. Common errors include:

1. "Duplicate charges" for the same service

2. Charges for services that were never performed

3. Incorrect patient information, such as name or insurance details

4. Charges for non-covered services that should not have been billed

Compare Bills with Your Insurance Explanation of Benefits

Your "Explanation of Benefits" (EOB) from your insurance provider is a crucial document that outlines what services were covered, how much your insurance paid, and what you owe. Compare your medical bill with the EOB to identify any inconsistencies. If your bill reflects a higher amount than what is shown on your EOB, this could indicate an error.

Verify Medical Codes

Medical billing relies heavily on "CPT codes" (Current Procedural Terminology) and "ICD codes" (International Classification of Diseases). These codes describe the services rendered and the diagnoses. If you are familiar with the codes related to your treatment, you can cross-check them against your bill. Incorrect coding can lead to inappropriate charges and denials from your insurance.

Reach Out for Clarification

If you notice any discrepancies or have questions, do not hesitate to reach out to your healthcare provider's billing department. Ask for a detailed breakdown of the charges and provide any documentation that may support your case. Most billing departments are willing to assist you in resolving any issues.

Keep Records of Your Healthcare Services

Maintaining detailed records of your healthcare services can make it easier to spot errors. Keep copies of all medical records, bills, and EOBs. Document your visits, treatments, and any communications with your providers. This information will be invaluable if you need to dispute a charge.

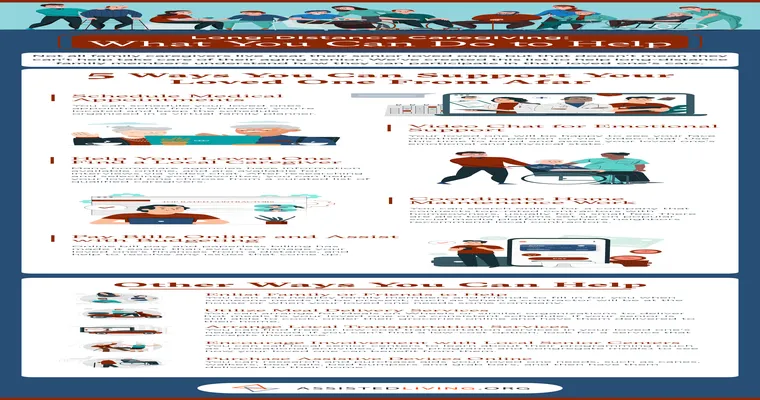

Utilize Patient Advocacy Resources

Many hospitals and healthcare systems offer "patient advocacy" services that can help you navigate billing issues. These advocates can assist you in understanding your bill, negotiating charges, and even appealing denied claims. Don’t hesitate to ask if such services are available.

Ask for Itemized Bills

Requesting an "itemized bill" from your healthcare provider can uncover hidden charges. Itemized bills break down every service provided, making it easier to identify discrepancies. This transparency can help you challenge any erroneous charges effectively.

Appeal Incorrect Charges

If you believe you have been incorrectly billed, you have the right to appeal. Most insurance companies have a formal appeal process that you can follow. Provide all necessary documentation, including your itemized bill and EOB, to support your case.

Consider Financial Assistance Programs

If you are struggling with "out-of-pocket expenses", inquire about "financial assistance programs" that may be available through your healthcare provider or local organizations. Many hospitals offer sliding scale fees based on income, which can significantly reduce your financial burden.

Conclusion

Spotting "medical billing errors" and reducing "out-of-pocket expenses" requires diligence and attention to detail. By following the steps outlined above, you can take control of your healthcare expenses and ensure you are not paying more than necessary. Remember, being proactive and informed is your best defense against costly billing mistakes. Always review your bills, understand your rights, and don’t hesitate to seek help when needed.