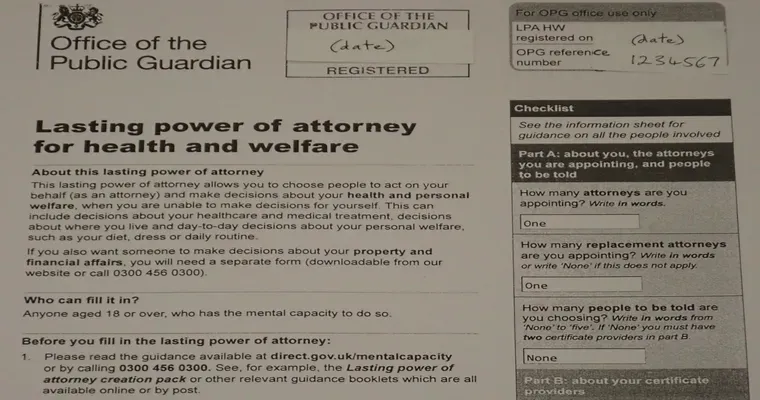

If you are navigating the complexities of "financial power of attorney (POA)" for a family member, particularly in the context of "real estate transactions", it is crucial to understand the implications, especially when your uncle is entering "long-term care" and will be "self-pay". This article will help clarify your responsibilities and the necessary steps to manage your uncle's financial affairs effectively.

When you hold a "financial POA", you gain the authority to make decisions regarding your uncle's finances, which may include managing his "real estate assets". This authority is especially important if he is transitioning into long-term care, as it may impact his financial situation and estate planning. Understanding the intricacies of how to utilize this power can help ensure that his assets are managed properly and that he receives the care he needs without unnecessary financial strain.

One of your primary responsibilities as a financial agent is to manage any "real estate transactions" your uncle may be involved in. This could involve selling his home to fund his long-term care or renting it out to generate income. It is essential to assess the value of his property and explore the best options for maximizing its worth while considering the costs associated with his care.

Additionally, being self-pay means that your uncle will be responsible for covering his long-term care expenses out-of-pocket. As his agent, you need to create a comprehensive financial plan that outlines how his assets, including real estate, will support his care needs. This plan should take into account the costs of daily living, medical care, and any additional services he may require in a long-term care facility.

It is also important to maintain clear records of all transactions and decisions made on behalf of your uncle. This includes documenting any sales, leases, or management decisions regarding his real estate. Transparency is key, as it not only protects you legally but also ensures that your uncle's wishes are honored throughout this process.

In summary, holding "financial POA" for your uncle during this critical time involves several important responsibilities, particularly concerning "real estate transactions" and managing his finances as he enters "long-term care" and becomes "self-pay". By understanding your role, creating a solid financial plan, and maintaining thorough documentation, you can help ensure that your uncle receives the care he needs while safeguarding his assets for the future.