If you have recently realized that you "missed the Medicare deadline", you are not alone. Many individuals find themselves in this situation, whether due to a lack of awareness or personal circumstances. Understanding your options is crucial to ensure you receive the healthcare coverage you need. In this article, we will explore what to do if you missed the enrollment period for Medicare and how to navigate your choices moving forward.

Understanding Medicare Enrollment Periods

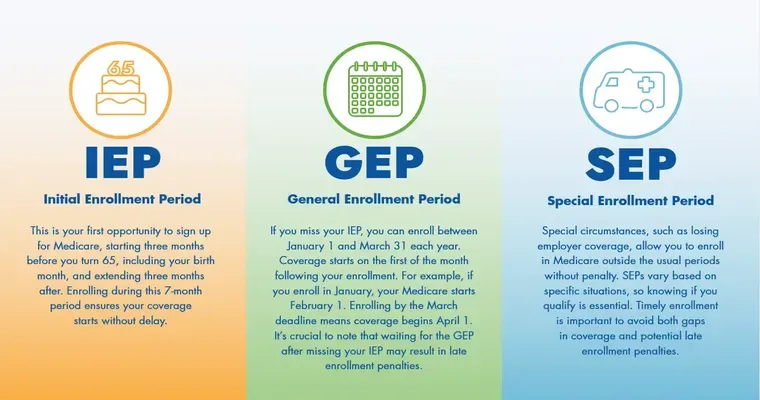

Medicare is divided into different parts: Part A, Part B, Part C, and Part D. Each has its own "enrollment periods", which can be confusing. The initial enrollment period typically starts three months before you turn 65 and ends three months after your birthday month. If you missed this window, you may have to wait for the "General Enrollment Period", which runs from January 1 to March 31 each year. Coverage begins on July 1, but this may not be ideal if you need immediate coverage.

Special Enrollment Periods

If you missed the Medicare deadline due to specific circumstances, you might qualify for a "Special Enrollment Period (SEP)". SEPs can be triggered by various life events, such as losing your employer-sponsored insurance, moving out of your service area, or experiencing a significant change in your health status. If you qualify for an SEP, you can enroll in Medicare outside the standard enrollment periods.

Late Enrollment Penalties

It is important to note that missing your Medicare deadline can lead to "late enrollment penalties". For Part B, if you do not sign up when first eligible, your monthly premium may increase by 10% for each full 12-month period you could have had Part B but did not sign up. Similarly, for Part D, if you go without creditable prescription drug coverage for 63 days or more, you may face a penalty when you do enroll.

What to Do Next

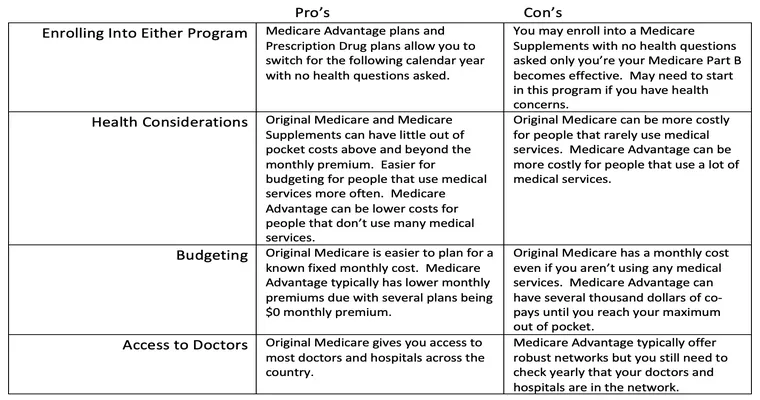

1. "Review Your Options": Take time to understand the different Medicare options available, including Medicare Advantage and standalone Part D plans. This will help you make an informed decision when the next enrollment period arrives.

2. "Contact Medicare": If you have questions about your specific situation, don’t hesitate to contact Medicare directly. They can provide guidance based on your circumstances and help you understand your options.

3. "Stay Informed": Keep an eye on upcoming enrollment periods. Make a note of the General Enrollment Period or any potential SEPs that may apply to you. Being proactive will help you avoid missing deadlines in the future.

4. "Explore Other Coverage Options": If you need immediate coverage and cannot wait for the next Medicare enrollment period, consider exploring other health insurance options. This could include short-term health insurance or coverage through the Health Insurance Marketplace.

Conclusion

Missing the Medicare deadline can feel overwhelming, but it is essential to understand your options and take action. Whether you qualify for a Special Enrollment Period, need to prepare for the General Enrollment Period, or explore other coverage options, you have the power to ensure you receive the health care you need. Stay informed, reach out for assistance, and take control of your healthcare journey.