In today's digital age, the threat of "identity theft" has become a significant concern for individuals and businesses alike. The "identity theft restoration process" is crucial for anyone who has fallen victim to this crime. Understanding the important aspects of this process can help victims regain their security and peace of mind. From reporting the theft to monitoring credit reports, being informed about these steps can make a substantial difference in the recovery journey.

Immediate Action Steps

The first step in the "identity theft restoration process" is to act quickly. Once you suspect that your personal information has been compromised, it is essential to report the incident to the relevant authorities. This includes filing a report with the "Federal Trade Commission (FTC)" and notifying local law enforcement. Having an official report can help in disputing fraudulent charges and restoring your identity.

Freezing Your Credit

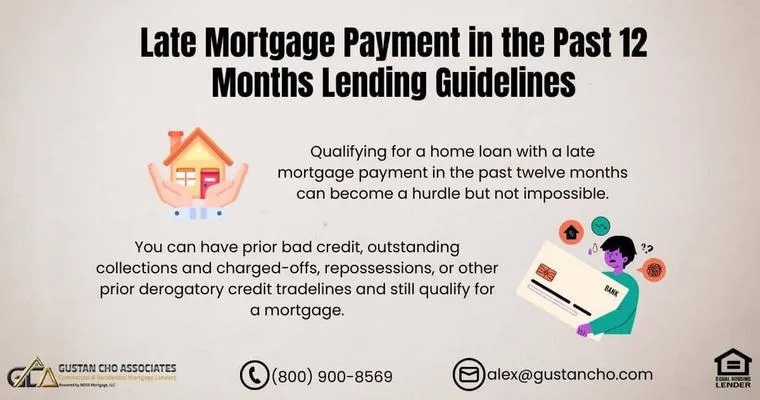

One of the most effective ways to prevent further damage after identity theft is to place a "credit freeze" on your accounts. A credit freeze restricts access to your credit report, making it difficult for identity thieves to open new accounts in your name. You can initiate this process with the major credit bureaus: "Equifax, Experian, and TransUnion". It's a crucial step in securing your financial identity.

Monitoring Your Accounts

After reporting the theft and freezing your credit, the next important aspect is to monitor your financial accounts closely. Regularly check your bank statements, credit card bills, and any other financial documents for any suspicious activity. If you notice any unauthorized transactions, report them immediately to your bank or credit card provider. This proactive approach can help mitigate further losses.

Disputing Fraudulent Charges

Victims of identity theft must dispute any fraudulent charges that appear on their credit reports or financial statements. This involves contacting creditors and providing the necessary documentation to prove that the charges are not yours. The Fair Credit Reporting Act (FCRA) gives consumers the right to dispute inaccuracies on their credit reports, making it essential to take advantage of this protection.

Identity Theft Protection Services

Consider enrolling in an "identity theft protection service". These services can monitor your personal information across the web, alert you to potential threats, and assist in the restoration process. While this may involve a monthly fee, many people find peace of mind knowing that experts are actively monitoring their identity.

Keeping Records

Throughout the "identity theft restoration process", it is crucial to keep detailed records of all communications. Document the dates and times of phone calls, names of representatives, and copies of any correspondence related to your case. This documentation can be invaluable if you encounter any issues during the recovery process.

Educating Yourself

Lastly, education plays a vital role in preventing future identity theft. Familiarize yourself with the different types of identity theft and the methods thieves use to steal personal information. By staying informed, you can take proactive steps to protect yourself and reduce the risk of falling victim again.

Conclusion

The "identity theft restoration process" can be daunting, but understanding its important aspects can empower victims to reclaim their identities. From immediate actions like reporting the theft to long-term strategies such as monitoring accounts and utilizing identity theft protection services, each step is vital. By taking these measures seriously, individuals can navigate the aftermath of identity theft more effectively and protect themselves from future threats.