Navigating the complexities of "in-home care tax deductions" can be challenging, especially for those who are "home bound" and rely on support services. Under IRS guidelines, expenses incurred for "companion-sitters" may qualify for tax deductions, providing financial relief for families and caregivers. Understanding how to leverage these deductions can significantly impact the overall cost of care.

Understanding Companion-Sitter Services

A "companion-sitter" provides essential non-medical support to individuals who are unable to care for themselves due to age, disability, or chronic illness. These services include companionship, assistance with daily living activities, meal preparation, and light housekeeping. While these tasks may seem minimal, they play a crucial role in enhancing the quality of life for "home bound" individuals.

Eligibility for Tax Deductions

To qualify for the "in-home care tax deduction", the caregiver must meet specific criteria set forth by the IRS. The expenses must be necessary for medical care, which includes services provided by companion-sitters. Here are key points to consider:

1. "Medical Necessity": The care provided must be deemed necessary for the well-being of the individual. This can often be verified through a physician's recommendation.

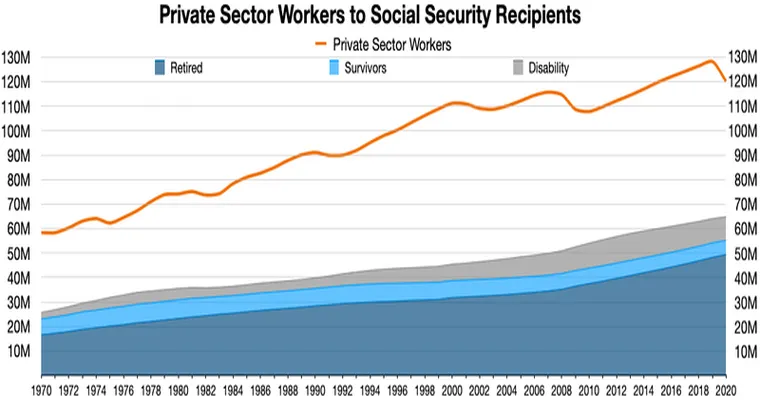

2. "Qualifying Expenses": Only certain expenses are deductible. This includes wages paid to the companion-sitter, social security taxes, and other related costs.

3. "Itemized Deductions": To benefit from these deductions, taxpayers must itemize their deductions on Schedule A of their tax return rather than taking the standard deduction.

4. "Adjusted Gross Income (AGI)": The total amount of medical expenses that can be deducted is limited to the portion that exceeds 7.5% of the taxpayer's adjusted gross income.

Documenting Expenses

To successfully claim the "in-home care tax deduction", thorough documentation is essential. Maintaining records of all expenses related to the companion-sitter is crucial. This includes:

Wages paid

Receipts for any related services

Documentation from healthcare providers that establishes the medical necessity of the care

Tax Benefits for Families

The financial implications of hiring a companion-sitter can be substantial. By understanding and utilizing the "in-home care tax deduction", families can alleviate some of the financial burdens associated with caregiving. This deduction not only helps those who are "home bound" but also supports their families in maintaining a healthier and more stable living environment.

Conclusion

For families with "home bound" loved ones, the "in-home care tax deduction" under the IRS companion-sitter categorization can offer significant relief. By ensuring that caregivers are compensated fairly and understanding the eligibility requirements for tax deductions, families can enhance the quality of care provided while also managing their finances more effectively. Always consider consulting with a tax professional to navigate the intricacies of these deductions and maximize potential benefits.