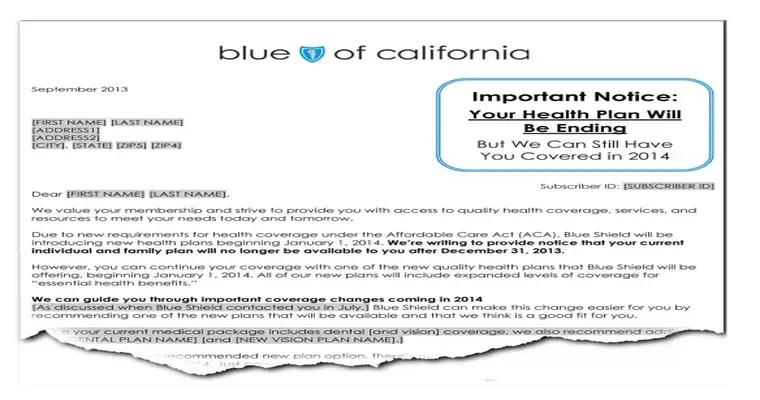

If you are facing the challenge of getting your "Part D drug company" to cover a "pain medication" that has recently been dropped from their formulary, you are not alone. Many patients rely on specific medications for chronic pain management, and when a drug is no longer covered, it can lead to significant health concerns and financial strain. Fortunately, there are steps you can take to advocate for your medication and potentially restore coverage.

Firstly, understanding the "formulary" is crucial. A formulary is a list of medications that a health insurance plan agrees to cover. Part D plans frequently update their formularies, which can result in the removal of certain drugs. To address this issue, start by reaching out to your Part D drug company. Contact their customer service department and inquire about the reasons for the drug's removal. This information can be vital as it might relate to cost, availability, or changes in FDA approval status.

Next, consider obtaining a "letter of medical necessity" from your healthcare provider. This letter should detail why the specific pain medication is essential for your treatment plan and how it benefits your health. A well-documented letter can significantly influence the decision-making process of the insurance company and may encourage them to reconsider their coverage decisions.

Another effective strategy is to request a "formulary exception". This is a formal appeal for your drug plan to cover a medication that is not included in their formulary. The request should include the letter from your healthcare provider, any relevant medical history, and evidence that other medications have been ineffective or unsuitable for your condition. Be sure to follow up on your request and keep records of all communications.

If your initial attempts do not yield positive results, you can escalate the issue by filing a "grievance" or an "appeal" with your Part D drug company. Each plan has its own process for handling grievances and appeals, so familiarize yourself with the specific procedures. You have the right to appeal decisions regarding coverage, and this process can sometimes lead to a favorable outcome.

Finally, don't hesitate to seek assistance from advocacy groups. Organizations focused on chronic pain management or specific diseases can offer guidance and support, including resources for navigating insurance issues. They may also provide information on alternative pain management options or other medications that are covered.

In summary, while losing coverage for a pain medication can be disheartening, there are several proactive steps you can take. By understanding the formulary, obtaining a letter of medical necessity, requesting a formulary exception, filing appeals, and seeking help from advocacy groups, you can increase your chances of getting your pain medication covered again. Be persistent and ensure that your voice is heard in the process of securing the necessary medication for your health and well-being.