If you have recently found out that your "parents do not have Medicare Part A coverage", you may be feeling concerned and confused about their healthcare options. Medicare is a crucial program that provides health insurance for individuals aged 65 and older, as well as certain younger people with disabilities. Understanding the implications of not having "Medicare Part A" is essential for ensuring that your parents receive the medical care they need.

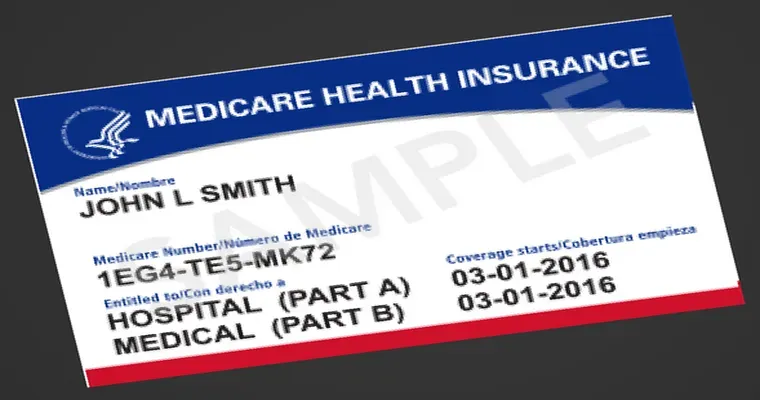

Medicare Part A primarily covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services. However, it is important to note that not everyone automatically qualifies for this coverage. Individuals who have not worked long enough to earn the required "work credits" or who have not paid Medicare taxes may find themselves without Part A coverage. This situation can lead to unexpected medical bills and stress for both the parents and their families.

If you have discovered that your parents lack Medicare Part A, the first step is to assess their eligibility. Most individuals qualify for Part A if they have worked for at least 10 years and paid Medicare taxes during that time. If they do not meet these criteria, they may need to look into purchasing coverage through the "Medicare Buy-In Program" or consider alternative options such as Medicaid, depending on their financial situation.

Additionally, it is crucial to consider the timing of enrolling in Medicare. If your parents missed the initial enrollment period, they may have to wait for the general enrollment period, which occurs annually from January 1 to March 31. Late enrollment can result in penalties, so acting promptly is essential.

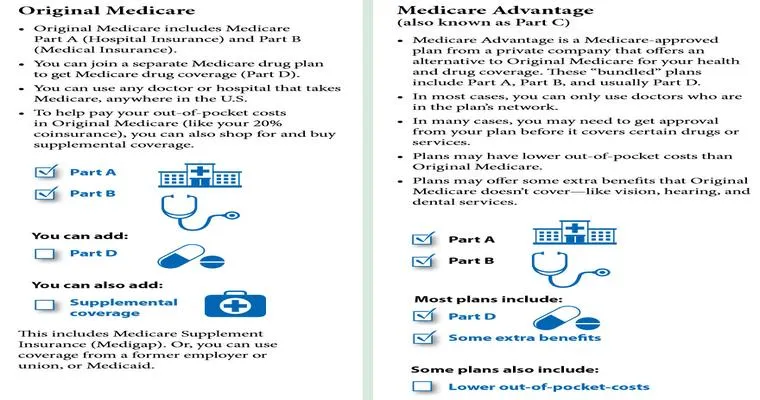

In the absence of Medicare Part A, your parents may need to rely on private health insurance or other assistance programs to cover their medical expenses. Researching different plans and options can help find a solution that fits their needs and budget. Furthermore, you may want to consult with a "Medicare expert" or a licensed insurance agent who can provide personalized advice and help navigate the complexities of Medicare.

In conclusion, discovering that your parents do not have "Medicare Part A coverage" can be alarming, but understanding their eligibility and available options is the first step toward ensuring they receive the healthcare they need. Explore all possibilities, including Medicare Buy-In Programs and private insurance, to secure their health and well-being.