Navigating the world of "Medicare Advantage plans" can often be challenging, especially when it comes to understanding "denials". Many beneficiaries find themselves facing unexpected "claim denials" for services they believe should be covered. This article aims to clarify the common reasons behind these denials, how to appeal them, and tips for ensuring that you receive the benefits you are entitled to.

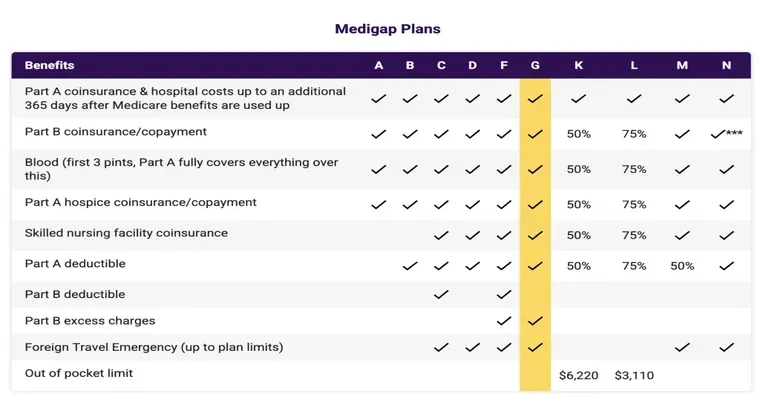

Medicare Advantage plans, also known as "Part C", are offered by private insurance companies and provide an alternative way to receive your Medicare benefits. While these plans often come with added perks, such as vision and dental coverage, they also come with specific rules and guidelines that can lead to "denials". Understanding these can help beneficiaries navigate the process more effectively.

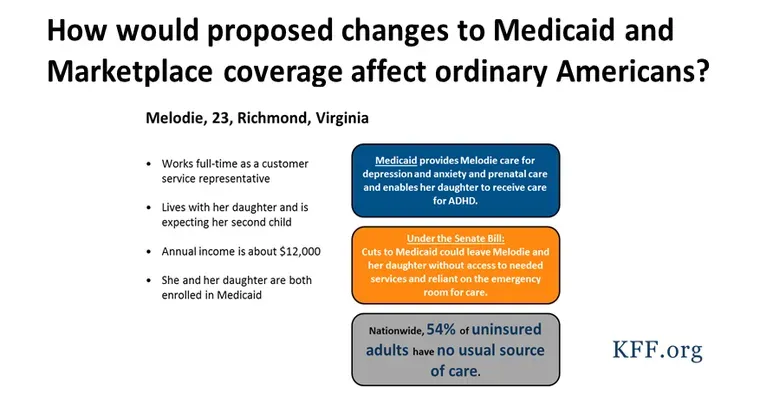

One of the primary reasons for "Medicare Advantage plan denials" is a lack of medical necessity. Insurance companies often require that services are deemed medically necessary to be covered. If your healthcare provider does not document the need for a certain service, your claim may be denied. It is essential to work closely with your healthcare provider to ensure that all necessary documentation is submitted when requesting services.

Another common reason for "claim denials" is the use of out-of-network providers. Many "Medicare Advantage plans" have specific networks of doctors and hospitals. If you receive care from a provider outside of this network without prior authorization, your claim may be denied. Always check with your plan to confirm whether your provider is in-network before seeking treatment.

Additionally, beneficiaries may experience denials due to procedural errors. Simple mistakes, such as incorrect coding, missing information, or late submissions, can lead to denied claims. It is crucial to review all paperwork carefully before submission and to follow up with both your provider and the insurance company to ensure that everything is in order.

If you do receive a "Medicare Advantage plan denial", don’t lose hope. You have the right to appeal the decision. The appeals process typically involves several steps, starting with a written request to your insurance company. Be sure to include all relevant information and documentation that supports your case. It is often helpful to seek assistance from a Medicare counselor or a professional who specializes in understanding "Medicare" and "Medicare Advantage plans".

Finally, to avoid future "denials", familiarize yourself with your plan's coverage policies and requirements. Regularly review your benefits and stay informed about any changes to your plan. Engaging in open communication with your healthcare provider and insurance company can also help reduce the chances of "claim denials".

In conclusion, while "Medicare Advantage plan denials" can be frustrating, understanding the common causes and knowing how to appeal can empower beneficiaries. By being proactive and informed, you can enhance your chances of receiving the full benefits of your "Medicare Advantage plan".