Navigating the landscape of "Medicare" and "Medicare Advantage" can be overwhelming for many seniors. Understanding the differences between these two options is crucial for making informed healthcare decisions. While "Medicare" is a federal health insurance program designed primarily for individuals aged 65 and older, "Medicare Advantage" plans offer an alternative that combines various services under one plan. In this article, we will explore the key differences, benefits, and considerations for choosing between "Medicare" and "Medicare Advantage".

Understanding Medicare

"Medicare" is divided into different parts, each covering specific services. Part A covers hospital stays, skilled nursing facility care, hospice, and some home health care. Part B focuses on outpatient care, including doctor visits and preventive services. Together, these parts provide a comprehensive safety net for essential healthcare needs. However, original "Medicare" does not cover everything; for example, it usually does not include dental, vision, or hearing services.

What is Medicare Advantage?

"Medicare Advantage", also known as Part C, is an alternative to original "Medicare". Offered by private insurance companies approved by Medicare, these plans often bundle coverage for Part A, Part B, and sometimes Part D (prescription drug coverage) into one plan. Many "Medicare Advantage" plans also include additional benefits, such as dental, vision, and wellness programs, which are not typically covered by original "Medicare".

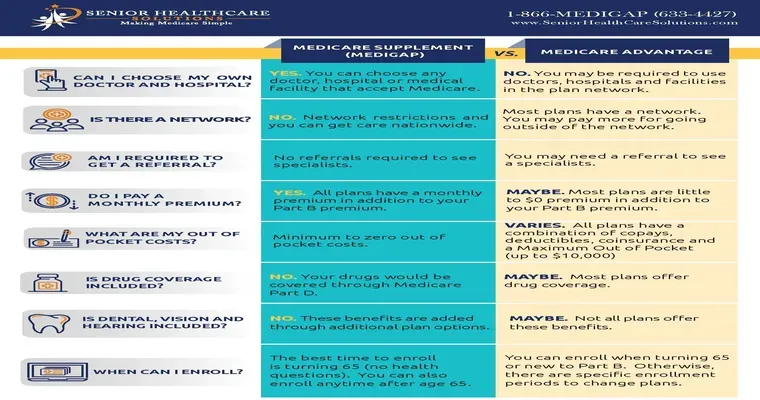

Key Differences Between Medicare and Medicare Advantage

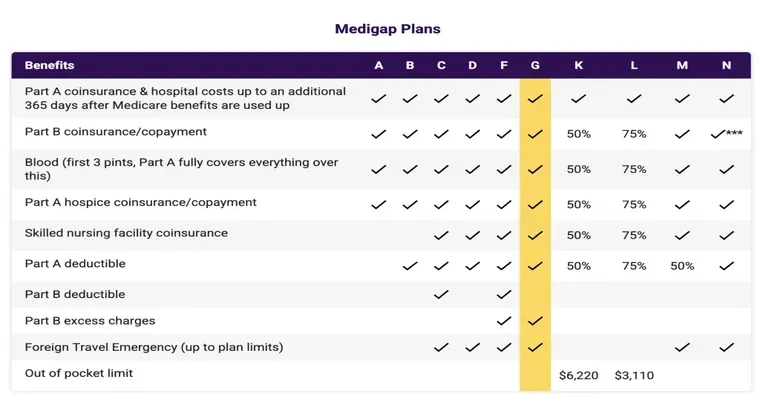

1. "Coverage Options": While original "Medicare" provides basic coverage, "Medicare Advantage" plans often include extra services. If you need comprehensive coverage that includes dental or vision care, a "Medicare Advantage" plan may be a better fit.

2. "Costs": Original "Medicare" typically requires beneficiaries to pay premiums, deductibles, and coinsurance. In contrast, "Medicare Advantage" plans may have lower premiums but could include higher out-of-pocket costs for certain services. It's essential to compare the overall costs associated with each option.

3. "Provider Networks": With original "Medicare", you have the flexibility to see any doctor or specialist that accepts Medicare. However, many "Medicare Advantage" plans may require you to use a network of doctors and hospitals. If maintaining your current healthcare providers is crucial, this is an important factor to consider.

4. "Prescription Drug Coverage": Original "Medicare" does not automatically include prescription drug coverage; you must enroll in a separate Part D plan. Many "Medicare Advantage" plans offer integrated drug coverage, simplifying your healthcare management.

Pros and Cons of Each Option

"Medicare" Pros:

Greater flexibility in choosing healthcare providers

No network restrictions

Guaranteed coverage regardless of pre-existing conditions

"Medicare" Cons:

Additional costs for services not covered

Need to enroll in separate plans for comprehensive coverage

"Medicare Advantage" Pros:

Potentially lower overall costs with bundled services

Additional benefits that may not be available with original "Medicare"

Simplified management with a single plan for various services

"Medicare Advantage" Cons:

Limited provider networks

Potential for higher out-of-pocket costs for specific services

Making the Right Choice

Choosing between "Medicare" and "Medicare Advantage" ultimately depends on your healthcare needs, budget, and preferences. Consider your current health status, preferred doctors, and whether you require additional services like dental or vision care. It may also be beneficial to consult with a Medicare counselor or use online resources to compare available plans in your area.

In conclusion, both "Medicare" and "Medicare Advantage" have unique benefits and drawbacks. By understanding the differences and evaluating your specific healthcare needs, you can select the best option that will provide you with the coverage and peace of mind you deserve.