As healthcare costs continue to rise, many seniors are seeking ways to manage their expenses. "Medicare Savings Programs" are designed specifically to assist eligible individuals in covering their premiums and other out-of-pocket costs. These programs can significantly alleviate the financial burden that often accompanies medical care, allowing seniors to access the healthcare services they need without sacrificing their financial stability.

Understanding Medicare Savings Programs

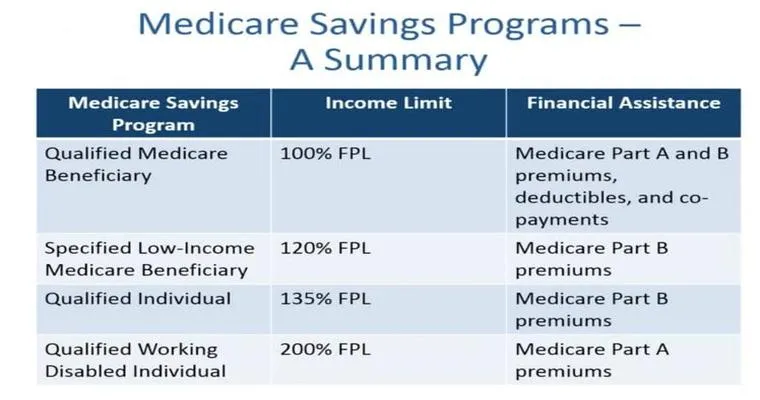

Medicare Savings Programs are state-administered initiatives that help low-income seniors pay for certain costs associated with Medicare. There are several types of programs available, including the Qualified Medicare Beneficiary (QMB) program, the Specified Low-Income Medicare Beneficiary (SLMB) program, and the Qualified Individual (QI) program. Each program has its requirements and benefits, but all aim to help seniors lessen the financial impact of their "Medicare premiums".

Who is Eligible for Medicare Savings Programs?

Eligibility for Medicare Savings Programs typically depends on income and asset limits that vary by state. Generally, seniors who qualify for these programs have limited income and resources. To qualify for the QMB program, for instance, your income must be at or below 100% of the federal poverty level. The SLMB and QI programs have slightly higher income thresholds, allowing more seniors to benefit from these programs.

Benefits of Medicare Savings Programs

Enrolling in a Medicare Savings Program can provide substantial financial relief. Participants in the QMB program may have their "Medicare Part A" and "Part B premiums" paid in full, along with any deductibles, coinsurance, and copayments. Similarly, the SLMB and QI programs help cover the Part B premium, making healthcare more affordable for seniors who are struggling with medical costs.

How to Apply for Medicare Savings Programs

Applying for Medicare Savings Programs typically involves contacting your state's Medicaid office or using online resources available through the Medicare website. You will need to provide proof of income, assets, and your Medicare enrollment status. The application process can vary by state, so it is essential to familiarize yourself with the specific requirements in your area.

Importance of Awareness and Enrollment

Many seniors are unaware of the "Medicare Savings Programs" and the financial assistance they offer. Advocates encourage seniors to explore these options, as they can lead to significant savings and improved access to healthcare. Awareness campaigns and outreach programs play a crucial role in informing eligible seniors about their options, ensuring they receive the support they need.

Conclusion

In summary, "Medicare Savings Programs" serve as a vital resource for seniors struggling to afford their Medicare premiums. By understanding the eligibility criteria and benefits associated with these programs, seniors can take proactive steps to secure financial assistance and access the healthcare services they require. If you or a loved one may be eligible, take the time to research and apply for these valuable programs, as they can make a significant difference in managing healthcare costs.