Choosing assisted living for a loved one is a significant decision that often involves navigating various "methods of payment" and "financing options". Understanding the financial aspects can help families make informed choices that best suit their needs. This article explores different payment methods, financing options, and resources available for families considering assisted living.

One of the most common "payment methods" for assisted living is "private pay". This option involves using personal savings, income, or assets to cover the costs of care. Many families choose this route because it offers flexibility and immediate access to services without the complexities of insurance or government aid. However, it is essential to budget carefully, as assisted living costs can be substantial and vary widely based on location and services provided.

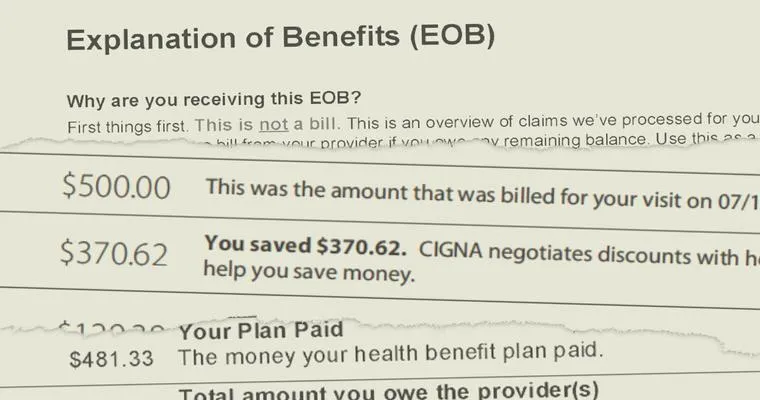

Another viable option is "long-term care insurance". This insurance is specifically designed to cover expenses related to assisted living and can significantly alleviate the financial burden. It is crucial to review the policy details, as coverage can vary. Some policies may cover only a portion of the costs, while others may have specific limitations or waiting periods. Families are encouraged to consult with a financial advisor or insurance expert to understand their options fully.

Many individuals and families also explore "Medicaid", a government program that can assist with the costs of assisted living for those who meet specific income and asset criteria. Medicaid programs vary by state, so it is essential to investigate the eligibility requirements and the application process in your area. Some states offer "waiver programs" that can help cover assisted living expenses for qualified residents.

Veterans may have additional financial options through the "Veterans Affairs (VA)" benefits. The VA provides various programs, including the Aid and Attendance benefit, which can help eligible veterans and their spouses cover the costs of assisted living. It is advisable for families to reach out to a VA representative to learn about the benefits available and the application process.

"Financing options" such as personal loans or home equity loans can also be considered for families who need assistance with upfront costs. These loans allow families to borrow money against their existing assets, such as their home, to fund assisted living expenses. However, it is essential to assess the terms, interest rates, and repayment plans before committing to any financing option.

Finally, many assisted living communities offer flexible payment plans that can help ease the financial burden. These plans may allow families to pay in installments or defer certain fees, making it easier to manage costs. It is advisable to discuss payment options directly with the facility to explore what arrangements might be available.

In conclusion, understanding the various "methods of payment" and "financing options" for assisted living is crucial for families navigating this important decision. By exploring private pay, long-term care insurance, Medicaid, VA benefits, personal loans, and community-specific payment plans, families can find the best financial solution that meets their needs. As always, consulting with financial advisors or professionals in the assisted living sector can provide additional guidance and support in making this significant transition.