When it comes to "Power of Attorney (POA)", many people may wonder about the implications it has on financial decisions, especially in sensitive situations like when a "grandmother" holds a POA for her "incompetent son". The question arises: can she legally give his money away upon her death? This article addresses this complex issue, clarifying the responsibilities and limitations surrounding a POA and the distribution of assets after death.

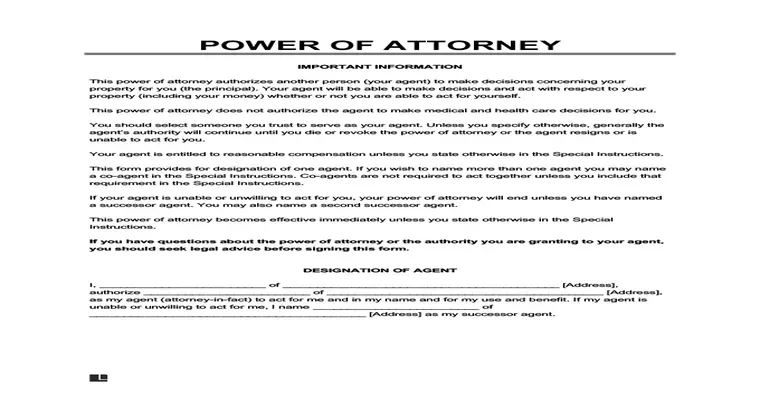

A "Power of Attorney" is a legal document that allows one person, known as the agent or attorney-in-fact, to act on behalf of another person, known as the principal. In this case, your grandmother is the agent for her son, who is unable to manage his own affairs. While she has the authority to make financial decisions for him while he is alive, the question of her ability to give away his money upon her death involves several legal considerations.

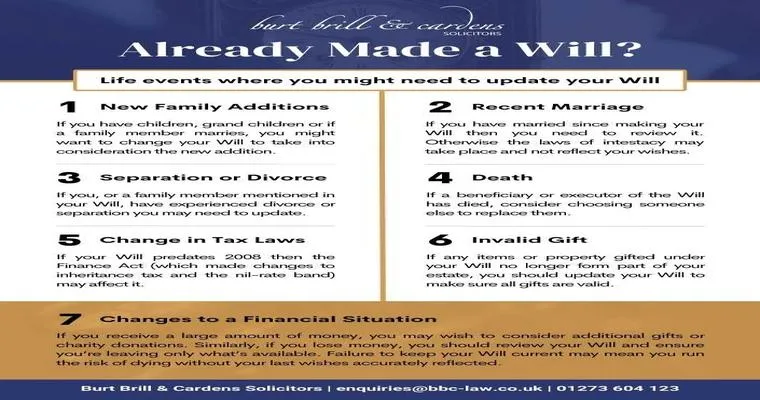

Firstly, it is essential to understand that a "POA" is only valid during the principal's lifetime. When your grandmother passes away, her authority as POA ceases to exist. Consequently, she cannot make decisions or distribute any of her son's assets after her death. Instead, her estate's distribution will be governed by her will or, if she dies intestate (without a will), by the laws of intestacy in her state.

If your grandmother wishes to leave financial provisions for her son in her will, she can do so. However, any money or assets that belong to her incompetent son are separate from her estate. Therefore, she cannot legally give away his money or assets as part of her estate plan. The son’s assets will be treated according to his own estate plan, or if he has none, they will pass to his heirs or beneficiaries as dictated by state law.

It is also important to consider the implications of incapacity in the context of "financial management". If your grandmother is concerned about her son's future care or financial stability, she might consider setting up a "trust" while she is still able to manage her affairs. A trust can provide a structured way to manage and distribute assets for someone who is unable to do so themselves, offering more control and protection than a simple POA.

In conclusion, while your grandmother can manage her son’s financial matters while she is alive through her role as his POA, she cannot give away his money upon her death. It is advisable for families in such situations to consult with a legal professional who specializes in elder law or estate planning to explore their options and ensure that both the grandmother and the son’s interests are protected. Understanding the nuances of "Power of Attorney" and estate planning can help avoid potential conflicts and ensure that financial matters are handled according to the wishes of all parties involved.