Dealing with a loved one who has "Alzheimer's disease" can be an overwhelming experience, especially when financial matters come into play. If your husband is in "stage 6 of Alzheimer’s" and you are facing challenges with obtaining an "equity loan", you may feel trapped by the limitations of your "Power of Attorney (POA)" agreement. Understanding your options is crucial for both your peace of mind and your financial well-being.

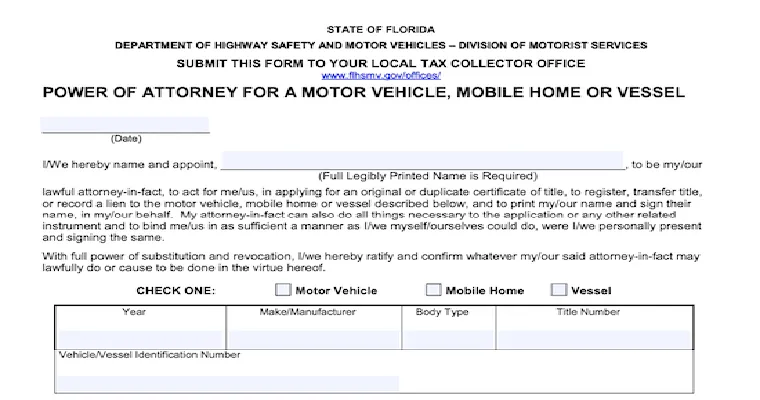

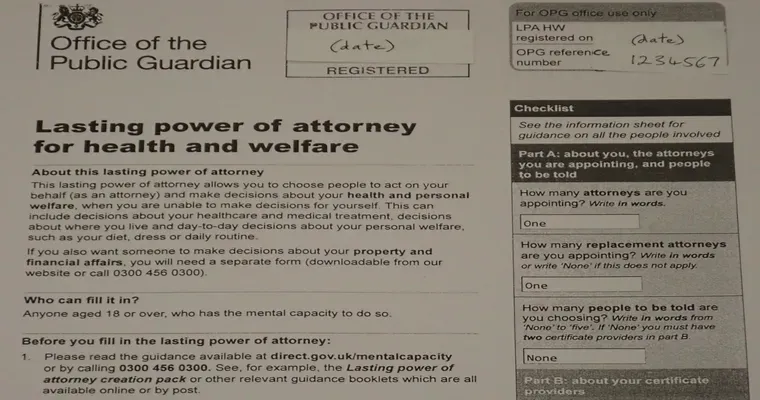

First and foremost, it is essential to review the specific terms of your "POA" document. A "Power of Attorney" allows you to make legal and financial decisions on behalf of your husband, but the extent of these powers can vary significantly from one agreement to another. If your POA explicitly states that you cannot take out an equity loan, it may be due to concerns about your husband's capacity to understand and consent to such financial decisions.

However, there are steps you can take to explore your options:

1. "Consult with an Attorney": Speak with an attorney experienced in elder law or estate planning. They can help interpret the terms of your POA and advise you on whether there are any legal avenues to challenge or modify its provisions. In some cases, it may be possible to amend the POA if it no longer serves your husband’s best interests.

2. "Consider a Financial Institution’s Guidelines": Different lenders have varying requirements when it comes to equity loans. Some may allow you to proceed with the loan application if you can provide medical documentation that confirms your husband’s condition and incapacity. A financial advisor can guide you through this process.

3. "Explore Other Financing Options": If an equity loan is off the table, consider alternative options for accessing funds. Personal loans, government assistance programs, or even a reverse mortgage may provide necessary financial relief without violating the terms of your POA.

4. "Seek Support from Family or Friends": Engaging with family members or close friends can provide emotional support and possibly financial assistance. They may be willing to help you navigate this challenging situation or even assist with loans or gifts to alleviate immediate financial pressures.

5. "Look into Medicaid Planning": Depending on your financial situation, you might qualify for "Medicaid", which can assist with long-term care costs. This may not provide immediate funds but can be part of a broader financial strategy as you navigate your husband’s care.

6. "Evaluate Your Husband’s Needs": It is crucial to assess your husband’s current needs and the potential future costs associated with his care. This evaluation can help you decide whether pursuing an equity loan is the best option or if there are other financial strategies that make more sense.

7. "Document Everything": Keeping detailed records of your husband’s condition, financial decisions, and any communications with lenders or legal advisors can be invaluable. This documentation may be necessary if you need to prove your husband’s incapacity or your role in managing his finances.

In summary, while the challenges presented by "stage 6 Alzheimer’s" and your "Power of Attorney" can be daunting, there are various avenues to consider. Consulting with professionals, exploring alternative financing options, and ensuring you have a clear understanding of your legal rights can empower you to make informed decisions. Remember, you are not alone in this journey, and seeking support can make a significant difference in navigating these complex issues.