Dealing with "Medicare" issues after the loss of a loved one can be a complex and emotional process. In 2006, I experienced this firsthand when my mom, who was on "Medicare", passed away. As her caretaker and only heir, I was shocked to receive a notice from "Medicare" stating that $85,000 was due. This unexpected financial burden added to the grief I was already experiencing. In this article, I will share my experience and offer insights into how to navigate similar situations involving "Medicare" claims and debts after the death of a beneficiary.

When I received the notice from "Medicare", I was initially confused and overwhelmed. The letter indicated that my mom owed a substantial amount, which raised several questions. How could this be? I promptly responded to the letter, informing them of her passing and providing the necessary documentation to prove it. However, I learned that addressing such claims is not always straightforward.

First, it is important to understand that "Medicare" is a federally funded program designed to provide healthcare coverage for eligible individuals, primarily those over 65 or with certain disabilities. However, when a beneficiary passes away, any outstanding debts or overpayments can be pursued by "Medicare" or other related entities. This can lead to complications for heirs or caretakers like myself.

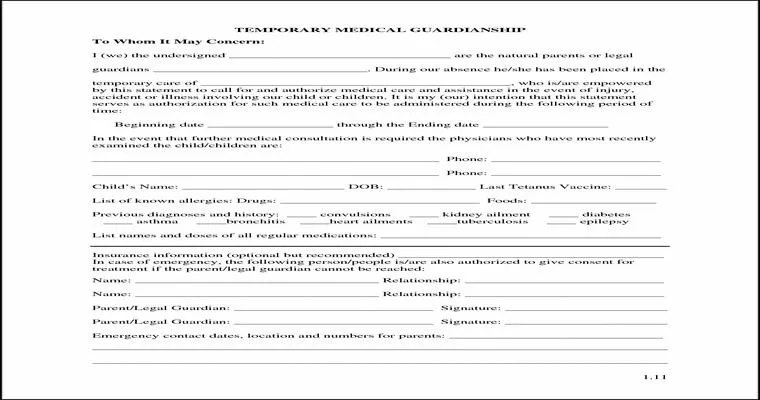

In my case, I had to gather all relevant documentation, including my mother’s death certificate and any previous correspondence with "Medicare". It was crucial to respond promptly and thoroughly to their notice, as delays can lead to further complications. I recommend keeping records of all communications with "Medicare", including dates, times, and the names of representatives spoken to.

After submitting my response, I waited anxiously for a reply from "Medicare". The process can be lengthy, and it’s essential to remain patient while following up periodically. Ultimately, I learned that "Medicare" may conduct a review of the account to determine whether the debt was valid or if it was an error due to the billing process.

It is also important to note that in some cases, if the debt is confirmed, heirs may not be responsible for paying it unless they co-signed any agreements or are legally obligated to do so. Understanding the implications of "Medicare" debts and your rights as an heir can help alleviate some of the stress during this difficult time.

If you find yourself in a similar situation, consider seeking guidance from a financial advisor or an attorney who specializes in elder law or healthcare. They can provide valuable insights and help you navigate the complexities of "Medicare" policies and estate obligations.

In conclusion, receiving a notice from "Medicare" regarding a deceased family member's debt can be distressing, but it is essential to respond appropriately and seek help if needed. By staying organized and informed about your rights and responsibilities, you can manage the situation more effectively. Remember, you are not alone in this process, and there are resources available to assist you as you navigate the challenges that arise after the loss of a loved one.