Finding out that your loved one, like a parent, does not have "Medicare Part B" coverage can be alarming, especially when it has been deactivated due to "non-payment". This situation can leave many individuals feeling vulnerable and without the necessary healthcare protections. If your mother has recently lost her "insurance", it is crucial to understand the steps you can take to address this issue and explore potential options for regaining coverage.

Understanding Medicare Part B

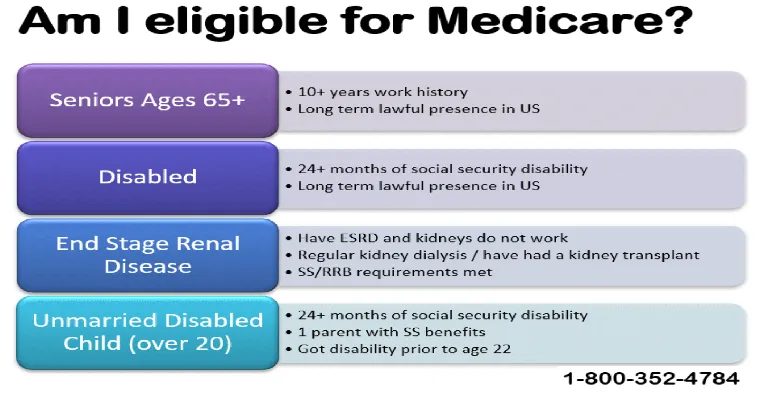

Medicare Part B is a vital component of the "Medicare program", which provides medical insurance for eligible individuals, primarily those aged 65 and older. This coverage includes essential services such as doctor visits, outpatient care, preventive services, and some home health care. Without Part B, your mother may face significant challenges in accessing necessary medical services, which can affect her overall health and well-being.

Reasons for Deactivation

The deactivation of Medicare Part B due to non-payment typically occurs when an individual fails to pay the required premiums. This can happen for various reasons, including financial difficulties or a lack of awareness regarding payment deadlines. It is essential to review the specific circumstances that led to this situation to address it appropriately.

Steps to Take After Deactivation

1. "Contact Medicare": The first step is to reach out to the Medicare helpline or visit the official Medicare website. They can provide detailed information about your mother's current status and the reasons for deactivation.

2. "Reinstate Coverage": Depending on the circumstances, it may be possible to reinstate Medicare Part B coverage. If the deactivation was due to non-payment, inquire about options for paying the owed premiums and getting her coverage reactivated.

3. "Special Enrollment Period": If your mother missed the general enrollment period, she might be eligible for a "special enrollment period" if she meets certain criteria. This could allow her to enroll again without facing penalties.

4. "Review Financial Assistance Options": If the non-payment was due to financial hardship, explore programs that assist low-income seniors with Medicare premiums and out-of-pocket costs. Programs like "Medicaid" or the "Medicare Savings Program" could provide valuable support.

5. "Explore Alternative Insurance Options": If reinstating Medicare Part B is not feasible, consider looking into alternative health insurance options. This could include private insurance plans or state-funded programs that offer similar coverage.

Preventing Future Issues

To prevent future lapses in coverage, it is essential to set up a system for managing premium payments. This could involve automatic payments or reminders to ensure that payments are made on time. Additionally, keeping track of any changes in income or eligibility for assistance programs can help maintain coverage.

Conclusion

Discovering that your mother does not have Medicare Part B due to non-payment can be distressing, but there are steps you can take to rectify the situation. By understanding the importance of Medicare coverage, exploring reinstatement options, and seeking financial assistance, you can help ensure that your mother has the healthcare protection she needs. Taking proactive measures now will not only provide peace of mind but also safeguard her access to essential medical services in the future.