Navigating the complexities of "Medicaid" eligibility can be challenging, especially for families dealing with "dementia". If your sister has dementia and resides with her daughter and son-in-law, it's essential to understand the criteria for qualifying for Medicaid. This program can provide vital financial assistance for long-term care and medical expenses, but various factors can influence her eligibility.

Understanding Medicaid for Dementia Care

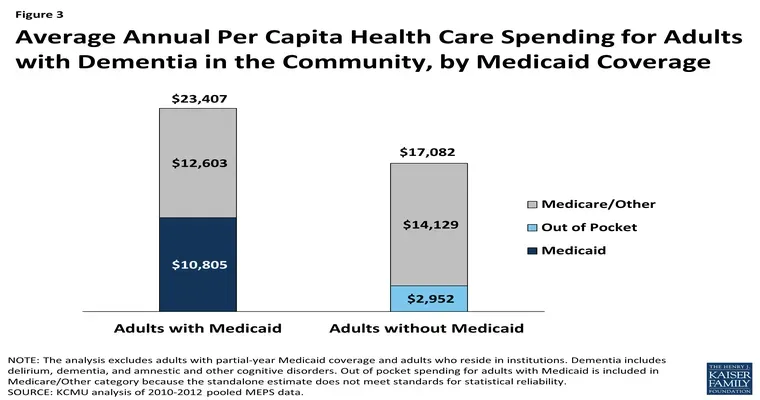

Medicaid is a state and federal program designed to assist individuals with low income and limited resources in covering healthcare costs. For someone with dementia, Medicaid can be crucial in accessing necessary medical services, including in-home care or nursing home facilities. Each state has its own eligibility criteria, which generally consider income, assets, and medical needs.

Income and Asset Limits

To qualify for Medicaid, your sister must meet specific income and asset limits. Generally, if she lives with her daughter and son-in-law, her income might be evaluated differently than if she were living alone. In many states, the income of the household can affect the eligibility determination. This means that her daughter and son-in-law's income may be considered when assessing your sister’s eligibility.

Typically, Medicaid sets a monthly income limit that varies by state. If your sister’s income exceeds this limit, she may still qualify through a spend-down process, which allows individuals to deduct certain medical expenses from their income before evaluating eligibility.

Medical Necessity for Dementia Patients

Another critical factor in qualifying for Medicaid is demonstrating a medical necessity for care. Your sister's diagnosis of dementia must be documented, and she may need to undergo an assessment to determine her level of care needs. This assessment typically evaluates her ability to perform daily living activities, such as bathing, dressing, and eating.

If her dementia has progressed to a point where she requires assistance, this could support her case for Medicaid eligibility. The documentation from healthcare providers will play a significant role in this process.

Living Arrangements and Medicaid Eligibility

Living arrangements can also impact her eligibility. Since your sister lives with her daughter and son-in-law, the state may consider the support she receives from them. In some cases, family caregivers can be compensated through Medicaid for providing care, which can help alleviate some financial burdens.

Applying for Medicaid

The application process for Medicaid can be complex. It often involves gathering necessary documentation, such as proof of income, assets, and medical records. It is advisable to reach out to a local Medicaid office or consult with a qualified elder law attorney to navigate the application process effectively.

Conclusion

In summary, your sister, who has dementia and lives with her daughter and son-in-law, may qualify for Medicaid, but it depends on various factors, including income, assets, and medical necessity. Understanding the specific eligibility requirements in your state and gathering the necessary documentation will be crucial steps in the application process. Seeking professional advice can also help ensure that your sister receives the support she needs during this challenging time.