In today's fast-paced world, having a "Power of Attorney (POA)" document is crucial for managing personal affairs effectively. A "POA doc" allows an individual, known as the principal, to appoint another person, referred to as the agent or attorney-in-fact, to make decisions on their behalf. This legal document is essential for various situations, including financial management, healthcare decisions, and estate planning. Understanding the different types of "POA documents" can help you choose the right one for your needs.

Types of POA Documents

There are several types of "POA documents", each serving a specific purpose. The most common types include:

1. "General Power of Attorney": This document allows the agent to act on behalf of the principal in a wide range of matters, including financial transactions and legal decisions. It is typically used when the principal is unable to manage their affairs due to illness or absence.

2. "Durable Power of Attorney": Unlike a general POA, a durable power of attorney remains in effect even if the principal becomes incapacitated. This makes it an essential tool for long-term planning, particularly in healthcare and financial matters.

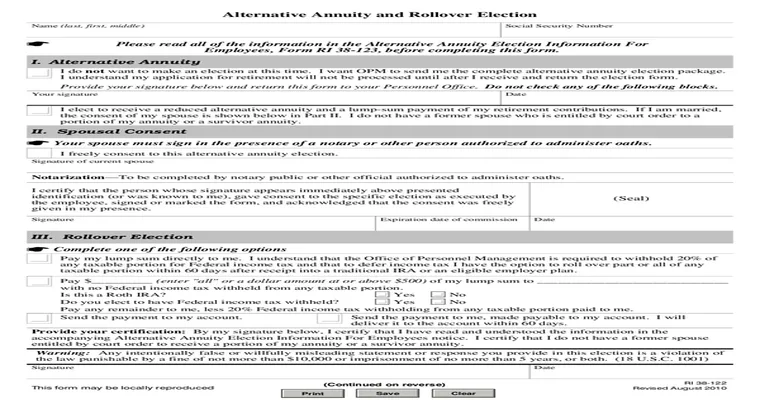

3. "Healthcare Power of Attorney": This specific type of "POA doc" grants the agent the authority to make medical decisions for the principal if they are unable to do so. It is crucial for ensuring that a person's healthcare preferences are honored during critical situations.

4. "Limited Power of Attorney": This document restricts the agent's authority to specific tasks or a particular timeframe. It is often used for temporary situations, such as real estate transactions or managing specific financial accounts.

Importance of Having a POA Document

Having a "POA document" is essential for several reasons:

"Decision-Making": It ensures that someone you trust can make decisions on your behalf when you are unable to do so. This can be particularly important in medical emergencies or when dealing with complex financial matters.

"Avoiding Court Appointments": Without a POA, family members may need to go through a lengthy and costly court process to gain the authority to make decisions for an incapacitated loved one.

"Flexibility and Control": A "POA doc" allows you to designate who will make decisions for you, ensuring that your wishes are respected. You can also specify the scope of the agent's authority, giving you peace of mind.

How to Create a POA Document

Creating a "POA document" involves a few essential steps:

1. "Determine Your Needs": Assess your situation to decide which type of POA is most appropriate for you. Consider whether you need a general, durable, healthcare, or limited power of attorney.

2. "Choose Your Agent": Select a trustworthy individual to act as your agent. This person should be responsible, reliable, and willing to take on the role.

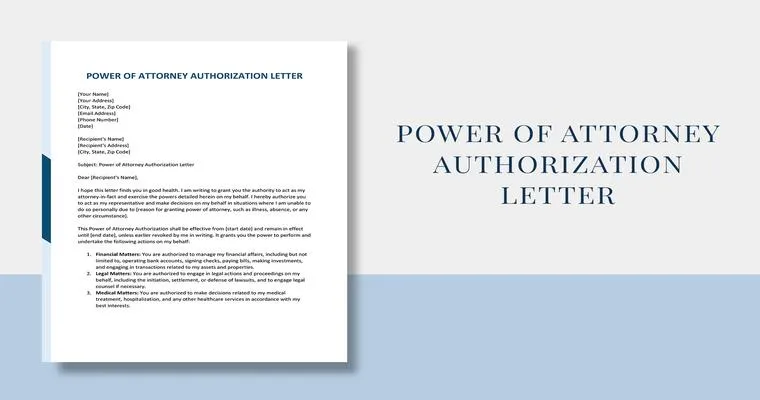

3. "Draft the Document": You can create a "POA doc" using templates available online, but it's often advisable to consult with a legal professional to ensure that the document meets all legal requirements in your state.

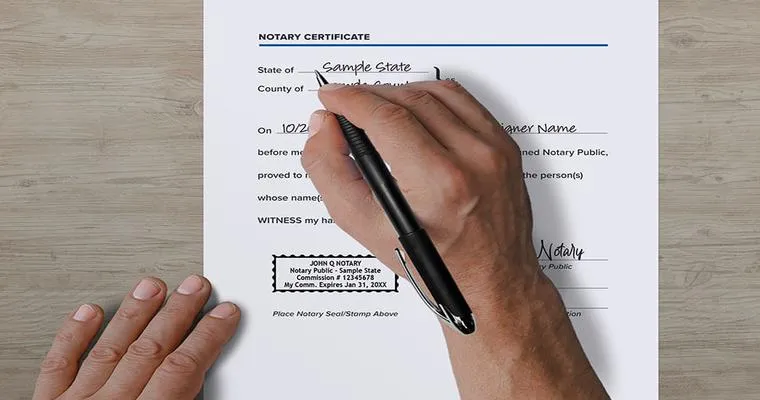

4. "Sign and Notarize": Once the document is drafted, it must be signed by the principal and, in many cases, notarized to be legally binding. Some states may also require witnesses.

Conclusion

In conclusion, understanding "POA documents" is vital for anyone looking to manage their affairs effectively. By having a "Power of Attorney", you can ensure that your wishes are followed and that someone you trust is in control when you cannot be. Whether it’s for healthcare decisions or financial management, having the right "POA doc" in place is an integral part of responsible planning. Make sure to consult a legal expert if you have any questions or need assistance in creating your POA document.