As individuals approach the later stages of life, "preparing for lookback periods", "personal care agreements", and the management of "vehicles" becomes increasingly important. These elements can significantly impact financial and legal situations, especially when it comes to Medicaid eligibility and estate planning. Understanding how to navigate these topics is crucial for ensuring that you and your loved ones are well-prepared for the future.

Understanding Lookback Periods

A "lookback period" refers to the time frame in which Medicaid reviews an individual’s financial transactions to determine eligibility for benefits. Generally, this period spans five years prior to the application for Medicaid. During this time, any significant asset transfers may be scrutinized, which can affect eligibility. Therefore, it is essential to plan ahead. If you anticipate needing long-term care services, consider discussing your financial situation with a professional who can help you understand how to minimize the impact of the lookback period.

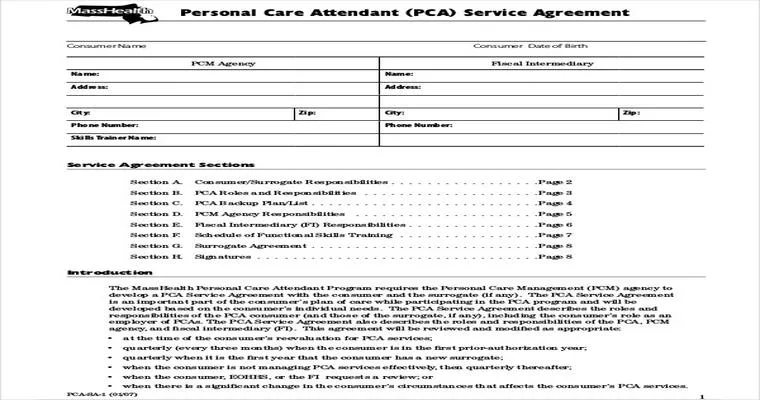

The Importance of Personal Care Agreements

"Personal care agreements" are contracts established between family members and caregivers that outline the terms of care provided. These agreements can be essential for a variety of reasons, including tax implications, Medicaid eligibility, and protecting family relationships. Having a clear, written agreement helps to avoid misunderstandings, ensures that caregivers are compensated fairly, and provides documentation that can be useful during the Medicaid application process. When drafting a personal care agreement, it’s advisable to consult with an attorney to ensure that it meets legal standards and addresses all necessary details.

Managing Vehicles in Later Life

As people age, managing "vehicles" can become a complex issue. Many may find that they no longer need a vehicle or that driving becomes unsafe. Planning for this transition involves several steps. Firstly, assess the necessity of your vehicle in light of your mobility needs and financial situation. If you decide to sell or transfer ownership of your vehicle, document the transaction properly to avoid complications during any lookback period. Additionally, consider alternative transportation options, such as community services or ride-sharing programs, to maintain independence while ensuring safety.

Legal and Financial Considerations

When preparing for lookback periods, personal care agreements, and vehicle management, it’s essential to consider both legal and financial aspects. Engaging with professionals in elder law and financial planning can provide invaluable guidance. They can help you navigate the complexities of Medicaid eligibility, draft comprehensive personal care agreements, and develop a strategy for vehicle management that aligns with your overall estate plan.

Conclusion

Preparing for lookback periods, establishing personal care agreements, and managing vehicles are critical components of planning for later life. By taking proactive steps and seeking the assistance of professionals, you can ensure that you and your loved ones are well-equipped to handle these important matters. With proper planning, you can create a supportive environment that promotes dignity and independence while safeguarding your financial future. Remember that the earlier you start this process, the better prepared you will be for the challenges that may lie ahead.