When dealing with "probate" and "Medicaid recovery efforts", it is essential to understand the intricate relationship between these two processes. Probate refers to the legal procedure through which a deceased person's assets are distributed, while Medicaid recovery efforts focus on reclaiming funds spent on healthcare services provided to individuals who were beneficiaries of the program. Understanding these concepts can help individuals navigate the complex landscape of estate planning and long-term care financing.

Probate is initiated upon the death of an individual and involves several steps, including validating the will, identifying assets, paying debts, and distributing the remaining assets to heirs. During this process, the "probate court" oversees the administration of the estate, ensuring that all legal requirements are met. This can often be a lengthy and costly process, making it crucial for individuals to have a well-drafted will and an understanding of their state's probate laws.

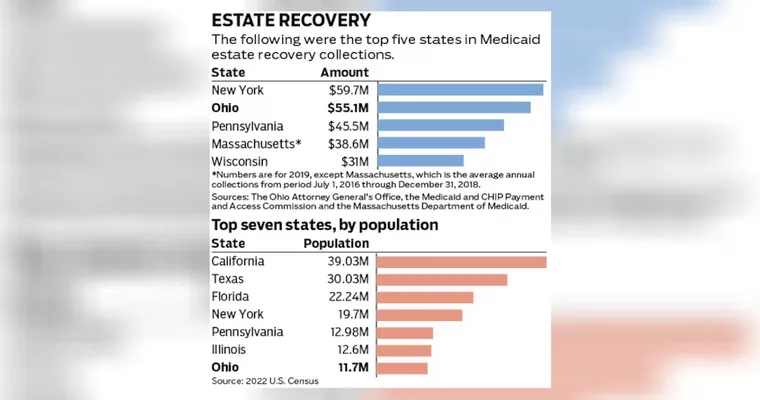

On the other hand, "Medicaid recovery" is a crucial aspect of Medicaid policy, aimed at recouping costs incurred by the state for providing medical assistance to eligible individuals. When a Medicaid beneficiary passes away, the state may seek to recover certain costs from their estate, particularly if the individual received long-term care in a nursing home or other medical facility. This process is governed by federal and state laws, which vary significantly from one jurisdiction to another.

One of the primary concerns surrounding Medicaid recovery is the potential impact on family members and heirs. Many individuals mistakenly believe that their home and other assets will automatically be exempt from Medicaid recovery efforts. However, this is not always the case. States have the authority to place liens on properties or seek reimbursement from the estate, which can lead to significant financial strain for surviving loved ones. Understanding the implications of these laws can help families prepare for and mitigate potential recovery claims.

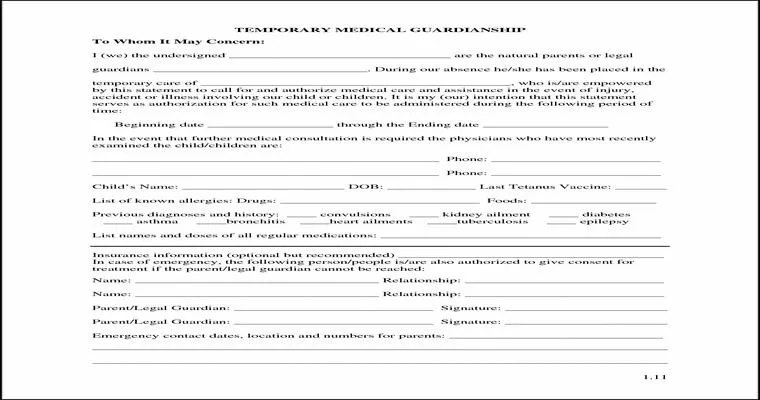

To navigate the complexities of probate and Medicaid recovery effectively, individuals are encouraged to engage in proactive estate planning. This includes setting up trusts, clearly outlining beneficiaries, and consulting with legal and financial professionals who specialize in elder law and estate planning. By taking these steps, individuals can better protect their assets from potential Medicaid claims and streamline the probate process for their heirs.

In conclusion, understanding the dynamics of "probate" and "Medicaid recovery efforts" is vital for anyone involved in estate planning or caring for aging loved ones. By being informed and proactive, individuals can ensure that their wishes are honored and that their families are not burdened with unexpected financial challenges after their passing.