When considering a move to a senior living community, one of the most significant decisions to make is whether to "rent" or "buy" your new home. Both options come with their own set of benefits and challenges, and understanding these can help you make an informed choice that suits your lifestyle and financial situation. This article will explore the key differences between renting and buying in senior living communities, outlining the advantages and disadvantages of each option.

Understanding the Basics

Renting typically involves paying a monthly fee to occupy a space within a community, while buying means purchasing a unit or home outright. Many senior living communities offer both "rental" and "ownership" options, catering to different preferences and financial capabilities.

Financial Considerations

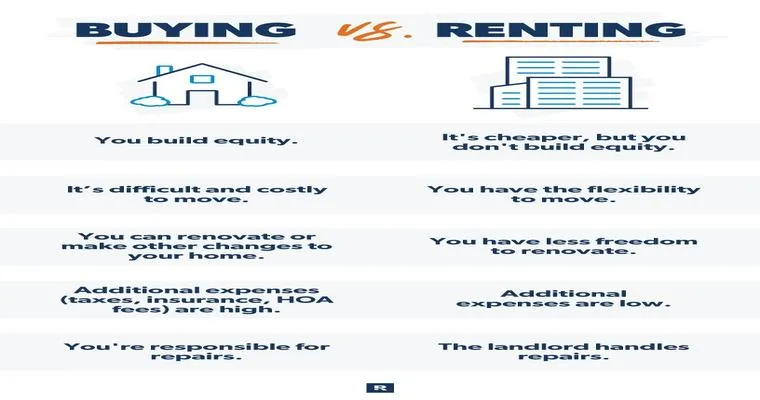

One of the primary factors to consider in the "renting vs. buying" debate is financial implications. Renting usually requires a lower upfront cost compared to buying. This is particularly beneficial for seniors who may want to preserve their savings or invest their money elsewhere. Renters also avoid maintenance costs, property taxes, and other expenses associated with ownership.

On the other hand, buying a unit can be seen as a long-term investment. Homeowners may benefit from property appreciation over time, and they have more control over their living situation. However, buyers must be prepared for the substantial initial investment and ongoing costs like maintenance, repairs, and community fees.

Flexibility and Commitment

Renting offers greater "flexibility". Seniors who choose to rent can easily relocate if their needs change or if they wish to explore a different community. This is particularly appealing for those who may not want to commit to a long-term arrangement.

Conversely, buying a home in a senior living community often requires a more significant commitment. This can provide stability and a sense of belonging, which is essential for many seniors. However, if circumstances change—such as health issues or the need for assisted living—selling a home can be a lengthy and complex process.

Lifestyle and Amenities

Many senior living communities provide a range of "amenities" and services, and both renters and owners typically have access to these. However, the experience can differ. Renters might find that their lease agreements include certain amenities as part of their monthly fee, while homeowners may have to pay additional costs for similar services.

Living in a community—whether renting or buying—often means access to social activities, fitness programs, and other resources that enhance quality of life. This can be a significant advantage, as it encourages social interaction and helps combat feelings of isolation.

Maintenance and Upkeep

When it comes to "maintenance", renting often means that the community management takes care of repairs, landscaping, and general upkeep. This can be a significant relief for seniors who may not be physically able to handle these tasks themselves.

In contrast, homeowners are responsible for maintaining their property. While this can allow for more personal customization, it can also add stress and responsibility that some seniors may prefer to avoid.

Conclusion

Ultimately, the decision between renting and buying in senior living communities depends on individual circumstances, preferences, and financial situations. Renting offers flexibility and lower upfront costs, making it an appealing choice for many seniors. On the other hand, buying can provide stability and potential long-term investment benefits.

Before making a decision, it's essential to consider your lifestyle needs, financial goals, and how long you plan to stay in the community. By weighing the pros and cons of both options, you can find the best living arrangement that meets your needs in your golden years.