When considering "healthcare options" for aging parents, many families find themselves contemplating the switch from a "Medicare Advantage plan" to a "regular Medicare plan". This decision can be complex, and understanding the "pros and cons" is essential for making an informed choice. In this article, we will explore personal experiences, benefits, and drawbacks of such a transition.

Understanding Medicare Advantage and Regular Medicare

Before diving into personal experiences, it is crucial to understand the difference between these two options. "Medicare Advantage", also known as Part C, is a bundled plan that includes "Medicare Part A", "Part B", and often "Part D" (prescription drug coverage). It is offered by private insurance companies and may include additional benefits such as vision, dental, and hearing coverage.

On the other hand, "regular Medicare" consists of "Part A" (hospital insurance) and "Part B" (medical insurance), which can be supplemented with a separate "Part D" plan to cover prescriptions. Many families are drawn to regular Medicare for its flexibility and broader choice of healthcare providers.

Personal Experiences

Many families have shared their experiences when switching their parents from a "Medicare Advantage plan" to a "regular Medicare plan". One common theme is the relief felt by caregivers when they realized that their parents had more control over their healthcare choices. One daughter recounted how her mother had experienced limited options with her Medicare Advantage plan, which restricted her to a narrow network of doctors. Upon switching to regular Medicare, she was able to access specialists and facilities that better suited her healthcare needs.

However, experiences can vary widely. Some families have reported that their parents found the transition challenging, especially when it came to understanding the different components of regular Medicare. A son noted that his father struggled with the idea of managing multiple plans, which led to confusion and anxiety.

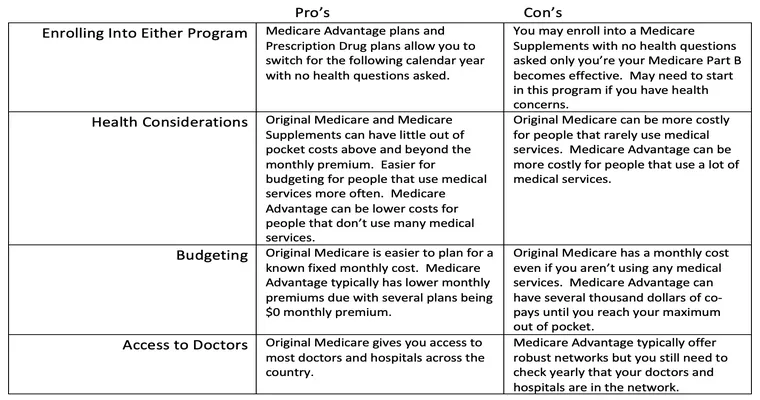

Pros of Switching to Regular Medicare

1. "Greater Flexibility": One of the most significant advantages of regular Medicare is the ability to choose any doctor or hospital that accepts Medicare, providing more options for care.

2. "No Network Restrictions": Unlike Medicare Advantage plans, regular Medicare does not impose network limitations, allowing beneficiaries to see specialists without referrals.

3. "Customizable Coverage": Regular Medicare allows beneficiaries to select a separate Part D plan for prescription drugs tailored to their specific needs.

4. "Fewer Surprises": Many families appreciate the transparency of costs associated with regular Medicare, as there are often fewer unexpected out-of-pocket expenses compared to some Medicare Advantage plans.

Cons of Switching to Regular Medicare

1. "Potentially Higher Costs": While some families find regular Medicare to be more flexible, others may face higher premiums and out-of-pocket costs, especially if they require supplemental coverage (Medigap).

2. "Complexity": Navigating the various parts of regular Medicare can be daunting for many seniors and their caregivers, leading to confusion and potential gaps in coverage.

3. "Limited Benefits": Unlike some Medicare Advantage plans that offer additional services such as vision and dental, regular Medicare typically does not cover these extras unless you purchase additional plans.

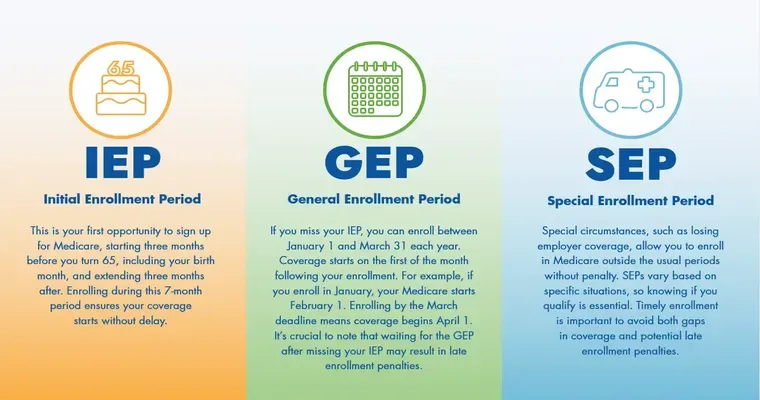

4. "Enrollment Periods": Switching to regular Medicare requires careful attention to enrollment periods. Missing these deadlines can result in penalties or delayed coverage.

Conclusion

Switching from a "Medicare Advantage plan" to a "regular Medicare plan" can be a significant decision for families caring for aging parents. While many have found the transition beneficial due to increased flexibility and choice, others have faced challenges in understanding the complexities of regular Medicare. It is essential to weigh the "pros and cons" carefully and consider personal healthcare needs, financial situations, and the preferences of your loved one. Consulting with a Medicare expert can also help clarify options and ensure that the right decision is made for your family.