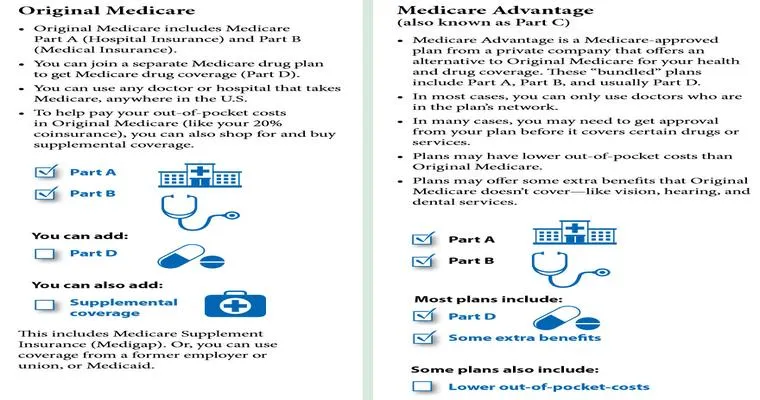

Understanding the "4 parts of Medicare" is essential for anyone approaching retirement or looking to navigate their healthcare options. Medicare is a federal health insurance program primarily designed for individuals aged 65 and older, but it also serves certain younger individuals with disabilities. The program consists of four main components: "Medicare Part A", "Medicare Part B", "Medicare Part C", and "Medicare Part D". Each part offers different coverage and benefits, and knowing what they entail can help you make informed decisions about your healthcare.

Medicare Part A

"Medicare Part A" is often referred to as hospital insurance. It covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services. Most people do not pay a monthly premium for Part A if they or their spouse paid Medicare taxes while working for at least 10 years. Coverage under Part A typically includes costs associated with your stay in a hospital, including room and board, nursing services, and certain medical supplies.

Medicare Part B

"Medicare Part B" is known as medical insurance. It covers outpatient care, doctor visits, preventive services, and some home health care. Unlike Part A, Part B requires a monthly premium, which can vary based on your income. Part B also has a deductible and typically covers 80% of approved medical expenses after the deductible is met. Understanding what Part B covers is crucial for managing healthcare costs and ensuring you have access to necessary medical services.

Medicare Part C

"Medicare Part C", also known as Medicare Advantage, combines the benefits of Part A and Part B into one plan, often offered by private insurance companies. Many Medicare Advantage plans also include additional benefits, such as vision, dental, and wellness programs. These plans can vary widely in terms of coverage, costs, and network restrictions. It is important to compare different Medicare Advantage plans to find one that meets your healthcare needs while staying within your budget.

Medicare Part D

"Medicare Part D" provides prescription drug coverage and is available to anyone who is enrolled in Medicare. Like Part C, Part D plans are offered by private insurance companies and can vary significantly in terms of the medications covered and the costs involved. Enrolling in a Part D plan can help offset the costs of prescription medications, making it an important consideration for those who rely on ongoing prescriptions.

Conclusion

Navigating the "4 parts of Medicare" can be complex, but understanding each component is vital for making informed healthcare decisions. From hospital stays covered by Part A to the comprehensive options available through Part C and the prescription drug plans of Part D, each part plays a crucial role in ensuring you receive the care you need. Whether you are approaching retirement or are already enrolled, taking the time to understand Medicare can lead to better health outcomes and financial savings.