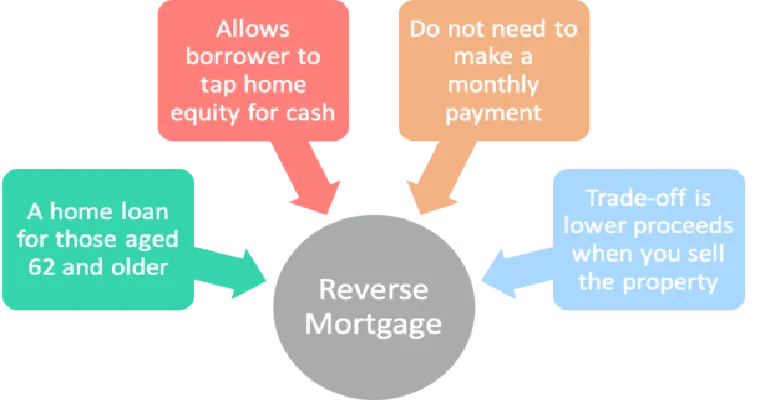

If you're a homeowner aged 62 or older, you may have heard about "reverse mortgage loans" as a way to access your home equity without selling your home. This financial product allows you to convert a part of your home equity into cash, which can be beneficial for seniors looking to supplement their retirement income. However, understanding the "ins and outs" of a reverse mortgage is crucial to determine if it is the right choice for you. In this article, we will explore how reverse mortgages work, their pros and cons, and factors to consider before making a decision.

What is a Reverse Mortgage?

A "reverse mortgage" is a loan specifically designed for older homeowners that lets them borrow against their home equity. Unlike traditional mortgages, where you make monthly payments to the lender, a reverse mortgage pays you. The loan amount is repaid only when you sell the home, move out, or pass away. This can provide a valuable source of income for retirees who may be house-rich but cash-poor.

How Does a Reverse Mortgage Work?

To qualify for a reverse mortgage, you must meet certain criteria, including:

1. "Age": The borrower must be at least 62 years old.

2. "Home Ownership": You must own your home outright or have a low remaining balance on your mortgage.

3. "Primary Residence": The home must be your primary residence.

4. "Financial Assessment": Lenders will perform a financial assessment to ensure you can meet obligations like property taxes, homeowner's insurance, and maintenance costs.

Once approved, you can choose to receive the funds as a lump sum, monthly payments, or a line of credit.

Pros of a Reverse Mortgage

1. "Supplement Retirement Income": Many retirees use reverse mortgages to help cover living expenses, healthcare costs, or to travel.

2. "No Monthly Payments": You are not required to make monthly mortgage payments as long as you live in the home.

3. "Stay in Your Home": You can continue to live in your home, allowing you to maintain your independence and comfort.

Cons of a Reverse Mortgage

1. "Accumulating Debt": The loan amount, plus interest and fees, can accumulate quickly, reducing the equity in your home.

2. "Impact on Inheritance": A reverse mortgage can deplete your estate, leaving less for heirs.

3. "Eligibility Criteria": Not everyone qualifies for a reverse mortgage due to strict requirements and financial assessments.

Is a Reverse Mortgage Right for You?

When considering whether a reverse mortgage is right for you, think about the following factors:

"Financial Goals": Assess whether the funds from a reverse mortgage will help you meet your financial needs or goals.

"Long-Term Plans": Consider how long you plan to stay in your home and how a reverse mortgage may affect your estate and heirs.

"Alternatives": Explore other options, such as downsizing or home equity loans, to determine which financial product best meets your needs.

Conclusion

A reverse mortgage loan can be a valuable financial tool for seniors seeking additional income in retirement. However, it is essential to weigh the "pros and cons" carefully and consider your long-term goals and financial situation. Consulting with a financial advisor or a reverse mortgage specialist can provide you with personalized insights, helping you make an informed decision about whether a reverse mortgage is indeed the right choice for you. Remember, knowledge is the first step towards financial empowerment.