When a loved one passes away, one of the key processes that may need to be undertaken is "probate". This legal process ensures that a deceased person's assets are properly distributed according to their wishes or state law. Understanding which "assets" must go through "probate" can help alleviate confusion during an already difficult time. In this article, we will explore the types of assets that are subject to probate and discuss the implications of this process.

What is Probate?

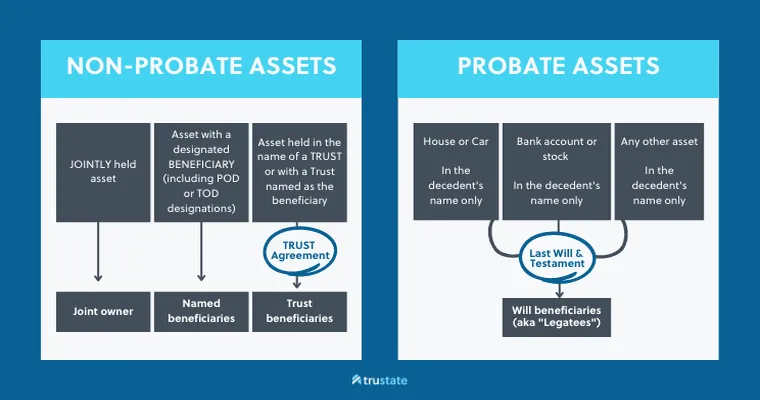

Probate is a court-supervised procedure that involves validating a deceased person's will, settling debts, and distributing the remaining assets to the rightful heirs. Not all assets are required to go through probate, and knowing the difference can save time and money.

Assets That Must Go Through Probate

1. "Real Estate": If a deceased person owned real estate solely in their name, it typically must go through probate. This includes homes, rental properties, and land. If the property was held in a trust or co-owned with rights of survivorship, it may bypass probate.

2. "Personal Property": Items such as vehicles, jewelry, collectibles, and other tangible personal property owned solely by the deceased are subject to probate. This is especially true if there is no clear beneficiary designated.

3. "Bank Accounts": Bank accounts held solely in the name of the deceased will generally require probate. However, if an account has a payable-on-death (POD) designation, it can pass directly to the named beneficiary without going through probate.

4. "Investments": Stocks, bonds, and other investment accounts owned solely by the deceased will also typically enter probate. Similar to bank accounts, if these assets have a transfer-on-death (TOD) designation, they can be transferred directly to the beneficiaries.

5. "Business Interests": If the deceased owned a business or had shares in a partnership, the business assets may need to go through probate to determine the distribution of ownership.

Assets That Do Not Go Through Probate

While understanding which assets must go through probate is essential, it is also helpful to know which assets do not. Assets that typically bypass probate include:

"Jointly Owned Property": Properties owned with another person, such as a spouse, often transfer automatically to the surviving owner.

"Living Trusts": Assets placed in a living trust are not subject to probate since they are already owned by the trust.

"Retirement Accounts": Accounts like IRAs or 401(k)s with designated beneficiaries pass directly to those individuals and do not go through probate.

"Life Insurance Policies": Similar to retirement accounts, life insurance payouts go directly to the named beneficiaries, bypassing probate.

Conclusion

Understanding which assets must go through probate is crucial for anyone dealing with the estate of a deceased loved one. By identifying which assets require this process, you can better prepare for the necessary steps in settling the estate. Consulting with an estate planning attorney can provide additional guidance and ensure that the probate process is as smooth and efficient as possible. Being aware of these details can help mitigate the emotional and financial stress often associated with losing a loved one.