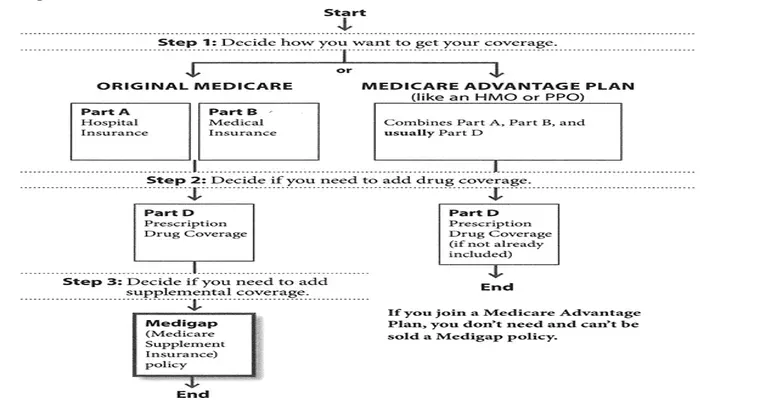

When considering your health coverage options, many people wonder whether they should opt for a "Medicare Advantage Plan" or utilize "secondary insurance coverage". While Medicare Advantage offers numerous benefits, there are significant reasons to explore the advantages of having secondary insurance instead. This article will delve into the reasons why secondary insurance can be a preferable choice for many individuals over a Medicare Advantage Plan.

One of the primary benefits of having "secondary insurance coverage" is the added flexibility it provides. Unlike Medicare Advantage Plans, which often come with a limited network of providers, secondary insurance can work alongside Original Medicare, allowing you to see a broader range of healthcare providers. This flexibility is especially important for individuals who have established relationships with their doctors or need specialized care that may not be available within the confines of a Medicare Advantage network.

Additionally, secondary insurance often offers a more comprehensive scope of coverage. Many Medicare Advantage Plans have specific limitations on services and may require referrals for specialist visits. Secondary insurance, on the other hand, typically covers a wider array of services and may not impose such restrictions. This can lead to better access to necessary healthcare services without the added hassle of navigating through a managed care plan's bureaucracy.

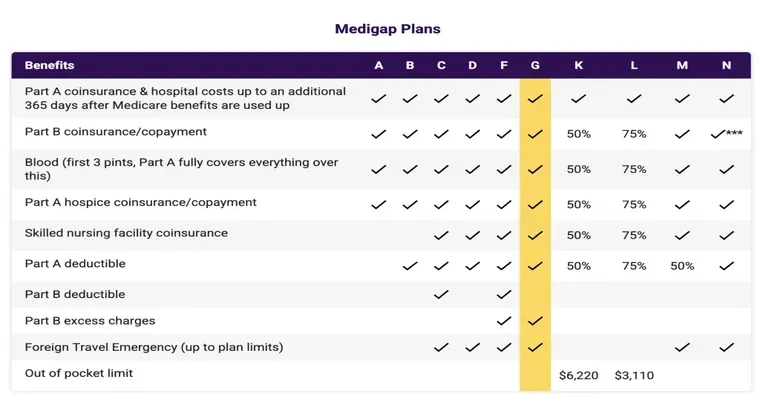

Cost is another critical factor to consider. While Medicare Advantage Plans may seem appealing due to their low premiums, they often come with high out-of-pocket costs. This can be particularly burdensome for those with chronic illnesses or frequent medical needs. Secondary insurance can help mitigate these costs by covering deductibles, copayments, and other expenses that Medicare Part A and Part B do not fully cover. This means that with secondary insurance, you may find yourself spending less overall on healthcare.

Moreover, when considering prescription drug coverage, secondary insurance can provide better options than Medicare Advantage Plans. Many Medicare Advantage Plans include a formulary that limits the medications covered or imposes high copayments for certain drugs. In contrast, secondary insurance may offer broader coverage for prescription medications, making it easier for you to access the treatments you need without facing exorbitant costs.

For those who travel frequently or spend part of the year living in different locations, secondary insurance can be a more advantageous option. Medicare Advantage Plans often restrict services to specific geographic areas, which can be problematic for individuals who require care while traveling. By relying on secondary insurance that complements Original Medicare, you can receive coverage regardless of where you are located within the United States.

In conclusion, while Medicare Advantage Plans may offer some appealing features, it is essential to consider the benefits of "secondary insurance coverage". The flexibility, comprehensive coverage, potential cost savings, enhanced prescription drug options, and nationwide access make secondary insurance a compelling alternative for many Medicare beneficiaries. If you are evaluating your health coverage options, take the time to assess whether secondary insurance might better meet your needs than a Medicare Advantage Plan.