If you are considering a "reverse mortgage", you may have encountered various options and lenders in your search. A reverse mortgage can be a beneficial financial tool for seniors looking to access the equity in their homes without having to sell or move. Recently, we just found the lender on a "reverse mortgage" who can help you navigate this process.

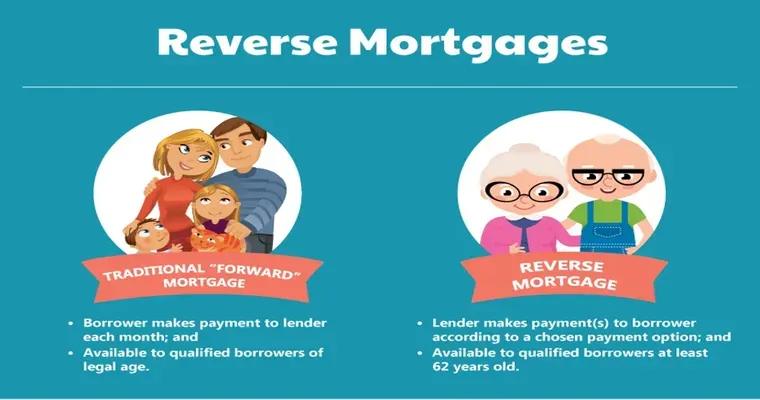

Understanding what a "reverse mortgage" is and how it works is crucial. Essentially, a reverse mortgage allows homeowners, typically aged 62 and older, to convert part of their home equity into cash. Unlike traditional loans, you do not need to make monthly payments. Instead, the loan is repaid when you move out of the home, sell it, or pass away. This can provide much-needed funds for retirement, medical expenses, or home improvements.

When searching for a lender, it is essential to consider several factors. Look for lenders who specialize in "reverse mortgages" and have a strong reputation in the industry. Check reviews and ratings to ensure you choose a trustworthy lender. Additionally, inquire about the types of "reverse mortgage" products they offer, such as Home Equity Conversion Mortgages (HECMs) or proprietary loans, as each has its own benefits and requirements.

Another critical aspect to consider is the fees associated with a "reverse mortgage". Understanding the costs upfront will help you make an informed decision. Lenders may charge origination fees, mortgage insurance premiums, and closing costs. It is advisable to compare offers from multiple lenders to find the best deal.

After doing your research, we found a lender who not only offers competitive rates but also provides personalized service. They guide you through the entire process, ensuring you understand the terms and conditions of your "reverse mortgage". Their team of experts is available to answer any questions you may have, making the experience smoother and less stressful.

In conclusion, if you are exploring the option of a "reverse mortgage", it is crucial to find a reliable lender who can meet your needs. With the right lender, you can unlock the potential of your home equity and enhance your financial security during retirement. Reach out to our recommended lender today and take the first step towards financial freedom with a "reverse mortgage".