Losing a parent is an incredibly emotional experience, and it can be even more overwhelming when you find yourself needing to manage their "bank account" to pay for essential expenses like "cremation", "bills", and other final arrangements. Understanding the steps to take during this difficult time can help alleviate some of the stress you may be feeling. Here are the critical steps to follow after your last parent passes away to ensure you can access their funds and settle any outstanding obligations.

1. Obtain a Death Certificate

The first step is to secure multiple copies of your parent’s "death certificate". This document is essential for a variety of legal and financial processes, including accessing bank accounts, filing insurance claims, and handling estate matters. You can typically obtain a death certificate from the funeral home or the local vital records office.

2. Locate Important Documents

Before you can access the bank account, gather important documents such as your parent's will, any trust documents, and financial statements. The will may designate an executor who will have the authority to manage the estate, including accessing bank accounts. If there is no will, the state’s intestacy laws will determine how the estate is handled.

3. Contact the Bank

Once you have the necessary documentation, reach out to your parent’s bank. Explain the situation and inquire about the procedures for accessing their "bank account". The bank will require a death certificate and may ask for additional documentation, such as proof of your identity and your relationship to the deceased. If your parent had a joint account, you may have immediate access to the funds.

4. Settle Immediate Costs

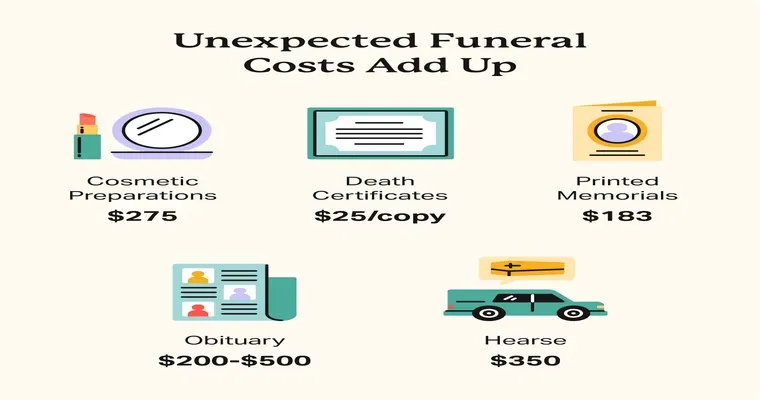

After gaining access to the bank account, prioritize settling immediate costs such as "cremation" and any outstanding bills. Many funeral homes will allow you to pay with funds directly from the bank account, which can help ease the financial burden during this difficult time.

5. Manage Other Financial Obligations

In addition to cremation costs, you may need to address other financial obligations, including utility bills, mortgage payments, and credit card debts. Make a list of all outstanding expenses and ensure that you have the necessary funds to cover them. If the estate has insufficient funds, you may need to explore other options, such as negotiating payment plans or seeking assistance from local charities.

6. Consult an Attorney or Financial Advisor

If the estate is complex or if you anticipate challenges in accessing the bank account, it may be wise to consult with an attorney or financial advisor. They can provide guidance on probate proceedings and help you navigate any legal obstacles you may encounter.

7. Keep Detailed Records

Throughout this process, maintain detailed records of all transactions and communications related to your parent’s estate. This documentation will be helpful in case any disputes arise or if you need to provide proof of payments to creditors.

Conclusion

Navigating the financial responsibilities after the death of your last parent can be daunting, but understanding the steps to access their "bank account" and settle "cremation" and other bills can make the process more manageable. Remember to take care of yourself during this emotional time and seek support from friends, family, or professionals when needed. By following these steps and staying organized, you can honor your parent’s memory while effectively managing their financial affairs.