Navigating the "Medicare Open Enrollment" period can be crucial for ensuring you have the right health coverage. If you miss the "Medicare Open Enrollment deadline", you may face significant consequences regarding your healthcare options. Understanding what happens next can help you make informed decisions about your health insurance needs.

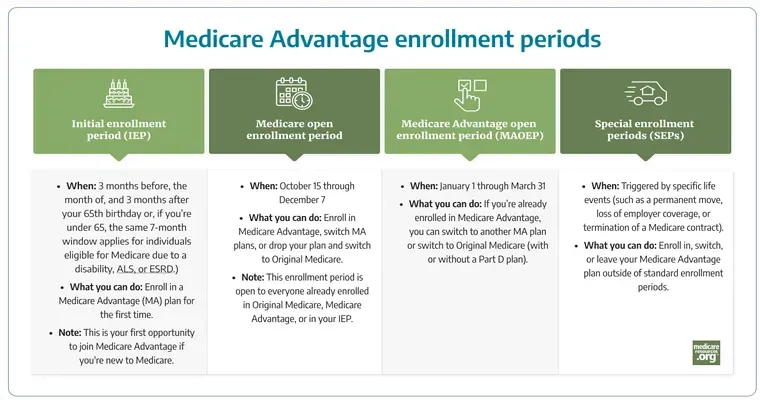

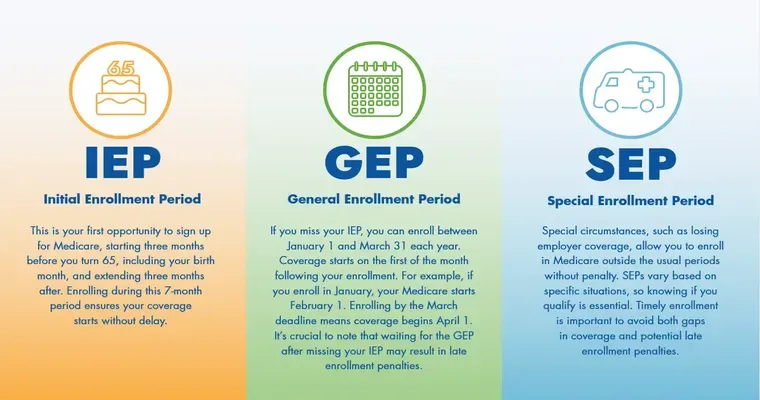

When the "Medicare Open Enrollment period" closes, you typically cannot make changes to your coverage until the next enrollment period unless you qualify for a Special Enrollment Period. This can be a critical time for many beneficiaries, as it is the only opportunity each year to enroll in, switch, or drop Medicare plans without facing penalties.

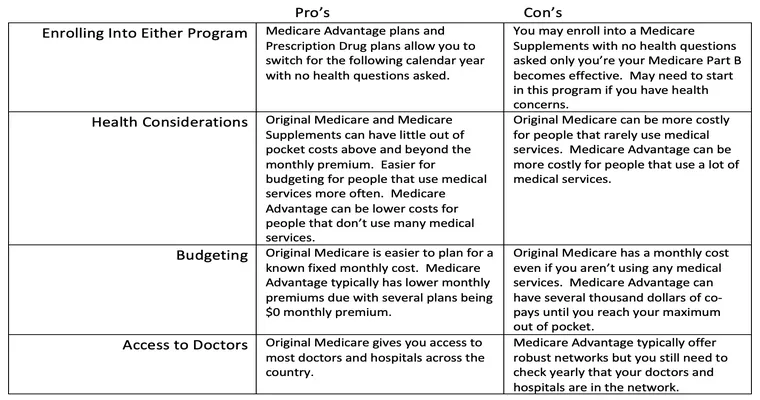

One major consequence of missing the deadline is the inability to enroll in a "Medicare Advantage Plan" or a "Medicare Prescription Drug Plan". If you are already enrolled in a plan, you may also be unable to make changes to your existing coverage. This restriction can lead to gaps in your healthcare access, especially if your current plan does not meet your needs.

If you miss the "Medicare Open Enrollment" deadline, you may have to wait until the next Open Enrollment period, which typically occurs from October 15 to December 7 each year. This waiting period can be particularly challenging for those who experience changes in their health needs or financial situations.

However, there are exceptions. If you experience certain qualifying events, such as moving to a new address, losing other health coverage, or experiencing a significant change in your life situation, you might qualify for a "Special Enrollment Period". During this time, you can make changes to your Medicare coverage without waiting for the next Open Enrollment period.

Failing to enroll during the designated timeframe can also result in late enrollment penalties. If you delay signing up for "Medicare Part B", for example, you may incur a penalty of 10% for each full 12-month period you could have had Part B but didn’t enroll. This penalty can increase your monthly premiums significantly, impacting your budget.

In conclusion, missing the "Medicare Open Enrollment deadline" can lead to limited options and potential financial penalties. It is essential to keep track of the enrollment dates and be proactive about your healthcare needs. If you find yourself in a situation where you have missed the deadline, consider reaching out to a Medicare representative or a healthcare advisor to explore your options. Being informed and prepared can make all the difference in managing your Medicare coverage effectively.