Navigating "Medicare Part D plans" can be a daunting task, especially with the complexities surrounding the "Donut Hole". Understanding these essential elements is crucial for beneficiaries looking to manage their prescription drug costs effectively. This article will provide a comprehensive overview of Medicare Part D, the infamous Donut Hole, and how it affects your healthcare expenses.

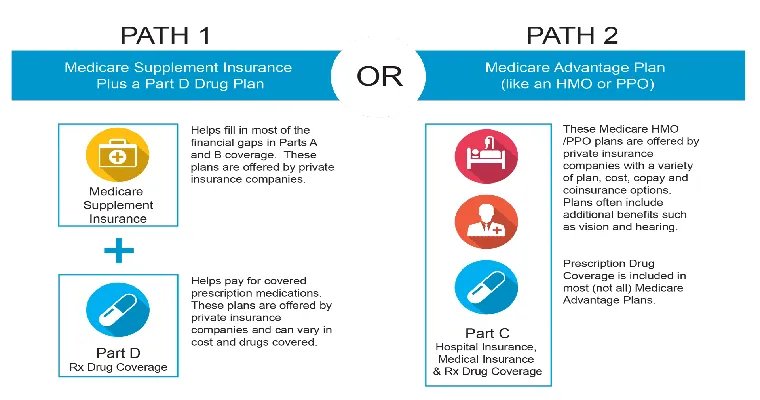

Medicare Part D is a federal program designed to help seniors and certain disabled individuals pay for prescription drugs. It is important to note that Part D is not provided automatically; beneficiaries must enroll in a "Medicare Part D plan" offered by private insurance companies. These plans vary in coverage, cost, and formulary, so it is essential to choose one that meets your specific needs.

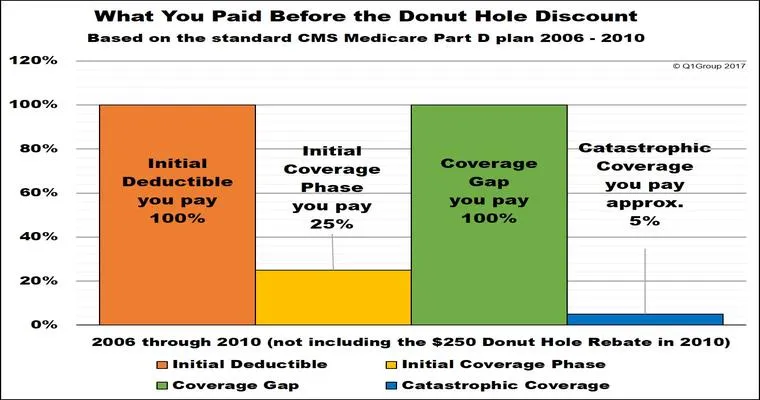

One of the most significant challenges beneficiaries face is the "Donut Hole", a coverage gap that can lead to high out-of-pocket costs for medications. The Donut Hole occurs after you and your plan have spent a certain amount on covered drugs in a calendar year. For 2023, this threshold is $4,660. Once you reach this limit, you enter the Donut Hole, where you are responsible for a larger share of your drug costs until you reach the catastrophic coverage threshold.

During the Donut Hole, you will pay a percentage of the cost of your medications rather than a copayment. For brand-name drugs, you will pay 25% of the cost, while for generic drugs, the amount can vary. However, it is essential to remember that the costs you incur during this phase will count toward your total out-of-pocket spending, helping you reach the catastrophic coverage threshold more quickly.

Fortunately, recent changes to Medicare have made the Donut Hole less burdensome for many beneficiaries. The "Affordable Care Act" introduced gradual reductions in the costs paid during the Donut Hole, and by 2020, beneficiaries pay only 25% for both brand-name and generic drugs while in this coverage gap. This means that more people can access the medications they need without facing insurmountable financial barriers.

To avoid falling into the Donut Hole, you should consider several strategies. First, review your "prescription drug formulary" to ensure that your medications are covered under your plan. Additionally, consult your healthcare provider about possible alternative medications that may be more affordable. Using generic drugs when available can also help reduce overall costs.

It is crucial to regularly review your Medicare Part D plan, as formularies and costs can change annually. Open Enrollment, which takes place from October 15 to December 7 each year, is an excellent opportunity to compare different plans and switch if necessary.

In conclusion, understanding "Medicare Part D plans" and the "Donut Hole" is vital for anyone eligible for Medicare. By being proactive and informed, you can make the most of your healthcare benefits and minimize your prescription drug costs. Stay educated about your options, and don’t hesitate to seek assistance from Medicare resources or a trusted advisor to help you navigate this essential aspect of your healthcare.