Understanding the "average cost of utility bills" is crucial for anyone budgeting their monthly expenses. Utility bills typically include "electricity", "water", "gas", and sometimes "internet" or "cable services". For many, these costs can take up a significant portion of their monthly income, especially for those relying solely on "Social Security (SS)" benefits. So, can you realistically live on SS while managing these necessary expenses?

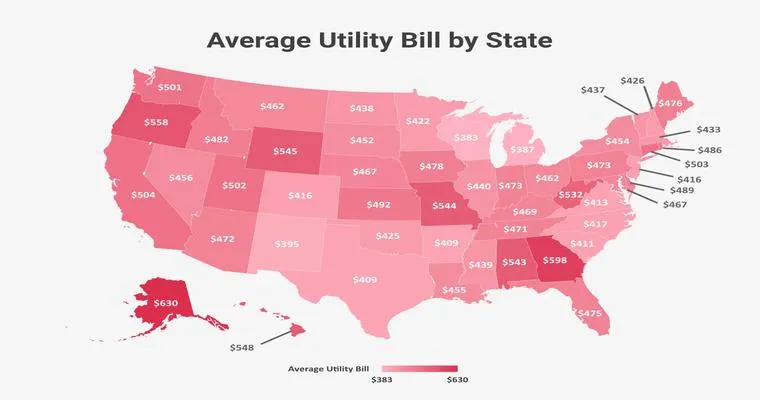

When evaluating the average cost of utility bills, it’s essential to consider geographical differences. As of recent data, the average monthly utility bill in the United States hovers around "$200 to $300". This amount can fluctuate based on the size of your home, energy efficiency, and local utility rates. For instance, larger homes or those in areas with extreme weather conditions may experience higher costs.

Moreover, understanding the breakdown of these utility costs can help you manage your budget more effectively. Typically, the largest portion goes to "electricity", followed by "heating" (whether gas or electric), "water", and "sewer services". By being mindful of these expenses, you can take steps to reduce your overall utility bills, such as using energy-efficient appliances or adopting water-saving practices.

Now, can you live on Social Security with these utility expenses in mind? The average monthly Social Security benefit for retirees is approximately "$1,500". While this may seem sufficient at first glance, once you deduct your utility bills, housing costs, groceries, and healthcare expenses, you may find yourself stretched thin.

For many, living solely on SS is challenging, particularly in high-cost living areas. It often requires careful budgeting and sometimes the need for additional income sources, such as part-time work or government assistance programs.

To improve your financial situation, consider the following strategies:

1. "Budgeting": Create a detailed budget that accounts for all your expenses, including utility bills, to better understand your financial standing.

2. "Reduce Utility Costs": Explore ways to cut down on your utility expenses, such as using energy-efficient light bulbs, unplugging devices when not in use, and being mindful of water usage.

3. "Additional Income": Look into part-time job opportunities or consider freelance work that aligns with your skills and interests.

In conclusion, while it is possible to live on Social Security, managing the "average cost of utility bills" requires careful planning and proactive financial strategies. Understanding your expenses and exploring options to reduce them can help you make the most of your income, ensuring a more comfortable lifestyle.