Deciding "when to take over finances" can be a pivotal moment in anyone's life. Whether you are just starting your career, entering a new relationship, or experiencing a significant life change, understanding the right time to step in and manage your financial situation is crucial. Taking control of your finances not only helps you achieve your goals but also provides a sense of security and empowerment.

Recognizing the Right Time

There are several key indicators that may signal it’s time to take over your finances. One of the most important factors is "life transitions". Events such as graduating from college, starting a new job, getting married, or having children can create the need for a more structured financial plan. These transitions often come with new financial responsibilities that require careful management.

Additionally, if you find yourself feeling overwhelmed by "debt" or unsure about your spending habits, it may be time to take over your finances. A clear understanding of your financial situation can help you create a budget, prioritize debt repayment, and set financial goals.

Assessing Your Current Financial Situation

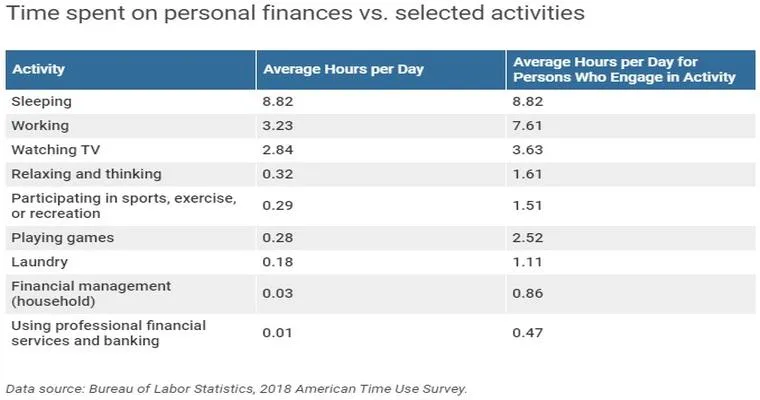

Before taking over your finances, it’s essential to assess your current financial situation. Start by taking stock of your income, expenses, debts, and savings. This assessment will give you a clearer picture of where you stand financially and what areas need your immediate attention.

If you are in a relationship, it’s also important to discuss finances openly with your partner. Establishing shared financial goals and understanding each other's spending habits can create a solid foundation for managing your finances together.

Creating a Budget

Once you have a clear understanding of your financial situation, the next step is to create a "budget". A budget allows you to allocate your income toward necessary expenses, savings, and discretionary spending. This structured approach can help you gain better control over your finances and make informed decisions about your money.

While creating a budget, consider using tools and apps that can help you track your expenses and visualize your financial goals. This can make the budgeting process more manageable and less daunting.

Setting Financial Goals

Taking over your finances also means setting achievable "financial goals". Whether your aim is to save for a vacation, pay off student loans, or build an emergency fund, having clear objectives can motivate you to stick to your budget and monitor your progress.

Remember to set both short-term and long-term goals. Short-term goals might include saving for a new gadget, while long-term goals could involve retirement savings or purchasing a home.

Seeking Professional Help

If managing your finances feels overwhelming, you may want to consider seeking assistance from a "financial advisor". A financial advisor can provide personalized advice, help you create a comprehensive financial plan, and offer strategies to achieve your goals.

Additionally, if you are navigating complex financial situations, such as divorce or inheritance, professional guidance can be invaluable in ensuring you make informed decisions.

Conclusion

In conclusion, knowing "when to take over finances" is essential for achieving financial stability and independence. By recognizing key life transitions, assessing your current financial situation, creating a budget, setting financial goals, and seeking professional help when needed, you can take control of your financial future. Remember, taking charge of your finances is not just about managing money; it’s about empowering yourself to make informed decisions that align with your life goals.