Selected reviews about elderly care communities

Selected reviews about elderly care communities offer valuable insights into the experiences of residents and their families. These reviews can highlight the strengths and weaknesses of different communities, helping you make an informed decision when choosing the right care for your loved one.

Condition improved when stop taking Aricept.

Some individuals may experience an improvement in their condition after discontinuing Aricept, a medication commonly used to treat Alzheimer's disease. This can occur due to a reduction in side effects or changes in brain chemistry. However, such outcomes vary significantly among patients, and further evaluation is essential for safe management.

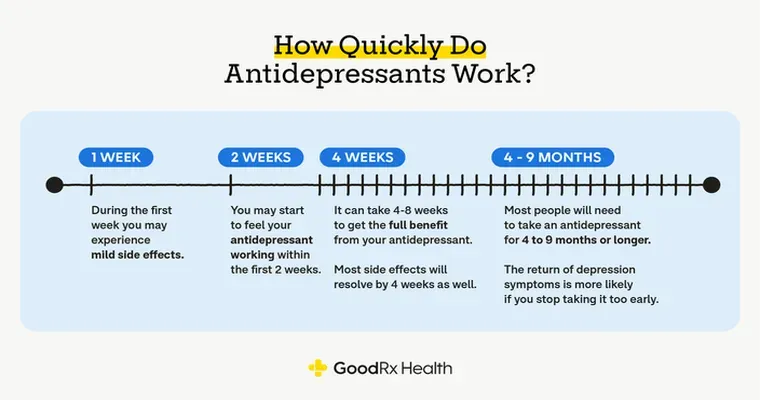

Changing to a different antidepressant, but feel ok right now.

Switching to a different antidepressant can be a daunting process, even when feeling stable. It’s important to communicate with your healthcare provider about any concerns or side effects. Staying informed and patient during this transition can lead to better long-term mental health outcomes and improved overall well-being.

Amazon One Medical: virtual visits to treat 30+ common conditions

Amazon One Medical offers virtual visits to address over thirty common health conditions, providing convenient access to medical care from the comfort of home. Patients can consult with healthcare professionals through secure online platforms, ensuring timely diagnosis and treatment while maintaining a focus on quality and patient satisfaction.

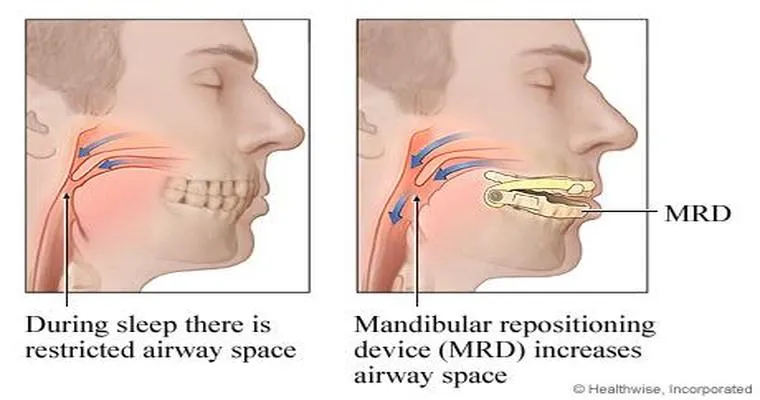

Treating Sleep Apnea Without a CPAP Machine

Treating sleep apnea without a CPAP machine involves lifestyle changes like weight loss, positional therapy, and avoiding alcohol. Oral appliances can help reposition the jaw, while certain exercises strengthen throat muscles. In some cases, medical interventions like surgery may be considered for long-term relief, improving sleep quality and overall health.

A Complete Guide to Durable Medical Equipment & Medical Supplies

This comprehensive guide offers essential information on durable medical equipment and medical supplies, covering types, usage, and selection criteria. It provides insights into the benefits of various products, helping individuals and caregivers make informed decisions for enhanced health and mobility, ensuring better quality of life for patients.

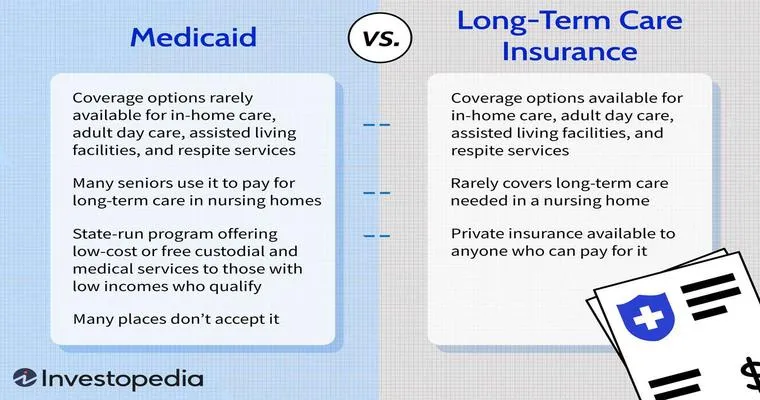

How will Medicaid be impacted if mom gave me money?

If a mother gifts her child a significant amount of money, Medicaid may be affected due to asset limits and eligibility criteria. This financial transfer could be viewed as a disqualifying asset, potentially leading to a penalty period during which the individual may not qualify for benefits.

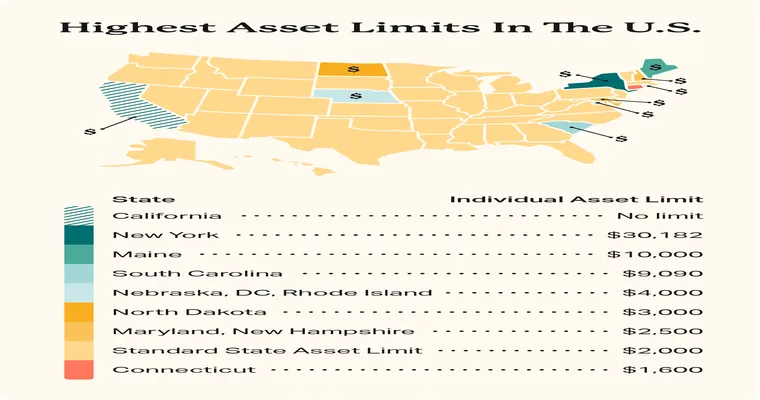

Check account balance barely over $2k, NH refusing to put into Medicaid pending, demanding full payment.

A person with a bank balance just over two thousand dollars is facing challenges in New Hampshire, where Medicaid eligibility is pending. The state is insisting on full payment for medical services, causing financial strain and concern about accessing necessary healthcare while waiting for assistance.

Will Medicaid take all of my mother's SSI and disability checks? How will she be able to buy things she needs and pay her bills?

Medicaid does not take all of your mother's SSI and disability checks. Instead, it may have certain income limits and requirements. She can still use her benefits to cover essential expenses, ensuring she has enough to buy necessary items and pay her bills while receiving healthcare support.

My mom is currently living in a nursing home. She just went on Medicaid. Mom has 25,000 in savings which is allowed. Can I buy her things?

Your mom can keep her savings while on Medicaid, as long as it stays within the allowed limit. You can buy her items that enhance her quality of life, like clothing or personal care products. However, be cautious about any gifts that could affect her Medicaid eligibility in the future.

My mom had to liquidate her annuity to pay for her assisted living facility. I'm told she will have to pay income tax on this money.

My mom had to sell her annuity to cover expenses for her assisted living facility. Unfortunately, this decision comes with the drawback of having to pay income tax on the funds received, which adds another layer of financial concern during an already challenging time for our family.

How to Talk to the Doctor About Your Elderly Parent or Spouse

When discussing your elderly parent or spouse with a doctor, be clear and concise. Prepare specific questions and concerns beforehand, and provide relevant medical history. Encourage open communication, actively listen, and take notes during the appointment to ensure you understand the doctor’s advice and recommendations for care.

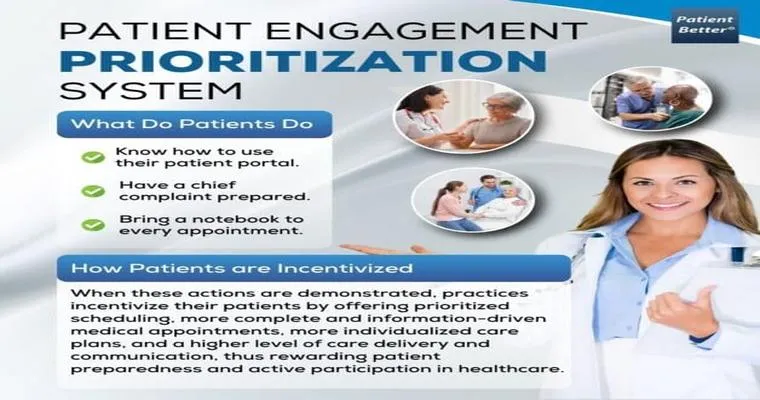

How to Be a Better Patient

Being a better patient involves actively participating in your healthcare. Communicate openly with your healthcare providers, ask questions, and express concerns. Keep track of your symptoms and medications, and follow treatment plans diligently. Building a trusting relationship with your medical team can enhance your overall health and well-being.

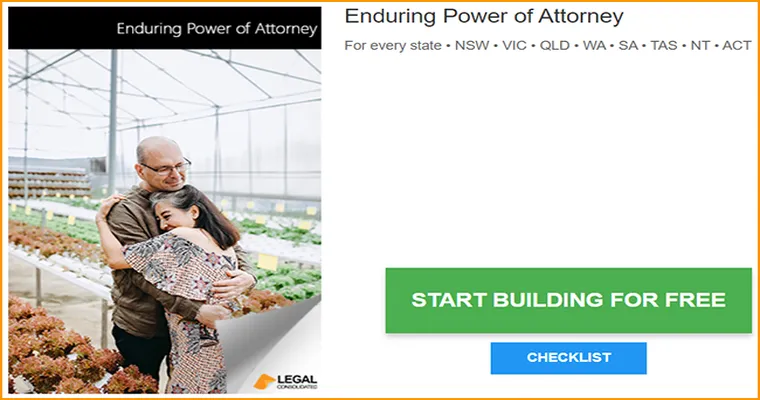

Financial POA for father, but only mother with dementia is joint account holder. Can I access their bank account after dad passes?

If your father had a financial power of attorney and your mother is the joint account holder but has dementia, accessing the bank account after your father's passing may depend on the bank's policies and state laws. It's advisable to consult a legal professional for guidance on managing the account in this situation.

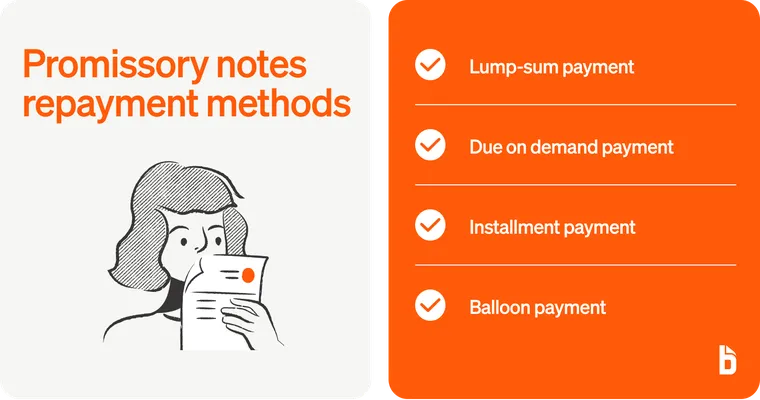

What is the benefit of a promissory note if you have to pay for the penalty period due to transfer, why not just private pay to begin with?

A promissory note can provide flexibility and structure for repayment, allowing individuals to manage their finances more effectively. Although there may be a penalty for transferring, this option can help preserve cash flow and provide a clear timeline for payment, making it a strategic choice compared to private pay upfront.

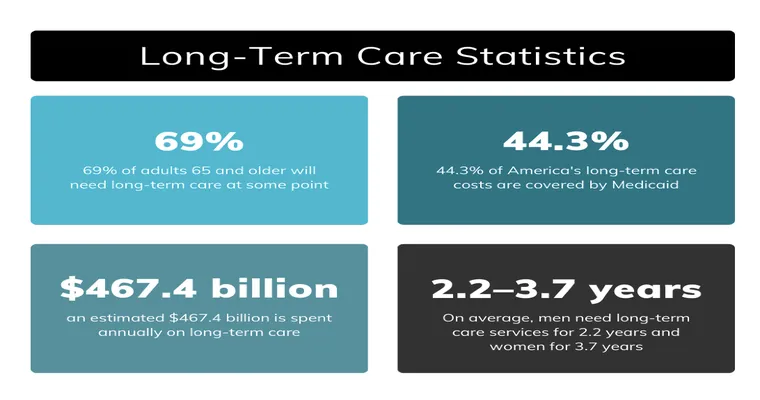

Spousal Impoverishment: Medicaid Spend-Down Rules for Married Couples

Spousal impoverishment rules in Medicaid aim to protect the financial stability of the non-institutionalized spouse when one partner requires long-term care. These regulations allow couples to retain certain assets and income, preventing the well spouse from becoming impoverished while ensuring that the institutionalized partner can access necessary medical care.

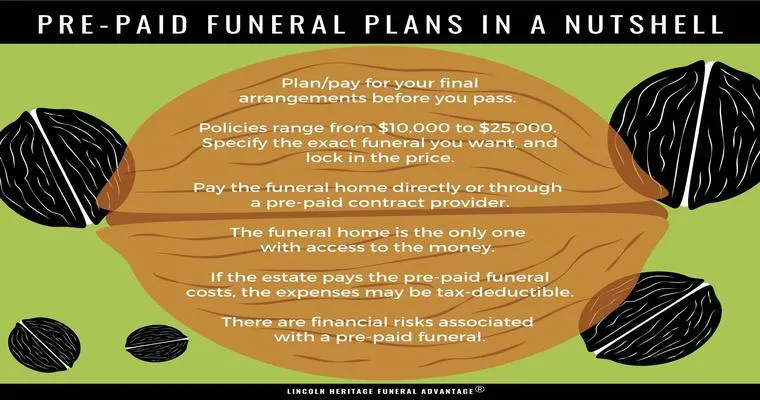

A Prepaid Funeral Plan Should Be Part of Your Medicaid Spend-Down

A prepaid funeral plan can be a strategic component of Medicaid spend-down, allowing individuals to allocate funds for future funeral expenses while ensuring eligibility for benefits. This approach not only preserves assets but also alleviates financial stress for loved ones during a difficult time, providing peace of mind and planning.

The selling of a person on Medicaid’s personal vehicle after they have already been accepted to help cover their expenses?

Selling a personal vehicle by an individual on Medicaid after being accepted for benefits can complicate their financial situation. The proceeds from the sale may impact their eligibility for assistance, as Medicaid has strict asset limits. It's crucial for recipients to understand how such transactions could affect their benefits.

Medicaid planning.

Medicaid planning involves strategies to help individuals qualify for Medicaid benefits while protecting their assets. It typically includes evaluating financial situations, restructuring ownership of assets, and understanding state-specific regulations. The goal is to ensure access to necessary healthcare services without depleting personal savings or property.

My husband has a monthly income of $2400 from pension and SS. I also have a pension and SS.

My husband receives a monthly income of $2400 from his pension and Social Security. I also have my own pension and Social Security benefits. Together, our financial situation allows us to manage our expenses comfortably while enjoying our retirement. We are grateful for the stability this income provides.

I cannot afford to keep my dad in memory care. We are currently self-paying as he does not currently qualify for Medicaid. What are my options?

Facing the financial burden of memory care for your dad can be overwhelming. If he doesn't qualify for Medicaid, consider exploring other options such as veterans' benefits, long-term care insurance, or financial assistance programs. Additionally, speaking with a financial advisor or social worker may help identify resources and alternatives.

Page 41 of 134