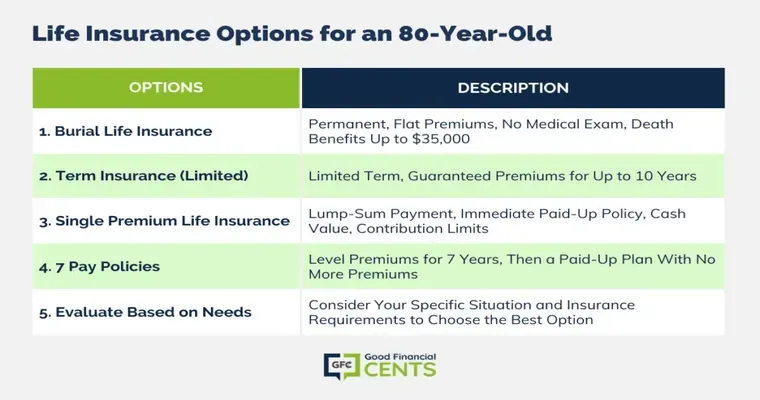

As seniors approach retirement age, understanding the various "life insurance options" available becomes increasingly important. With the right coverage, seniors can ensure financial security for their loved ones while also addressing specific needs that arise in later life. In this article, we will explore four popular "life insurance options" for seniors, helping you make an informed decision about your future.

1. Term Life Insurance

"Term life insurance" is a straightforward option that provides coverage for a specified period, usually ranging from 10 to 30 years. This type of policy is often more affordable than other options, making it an appealing choice for seniors looking to cover temporary financial obligations, such as a mortgage or college expenses for grandchildren. Once the term ends, the coverage ceases, and there is no cash value accumulated. However, if your primary goal is to ensure financial protection for a specific period, term life insurance can be an excellent choice.

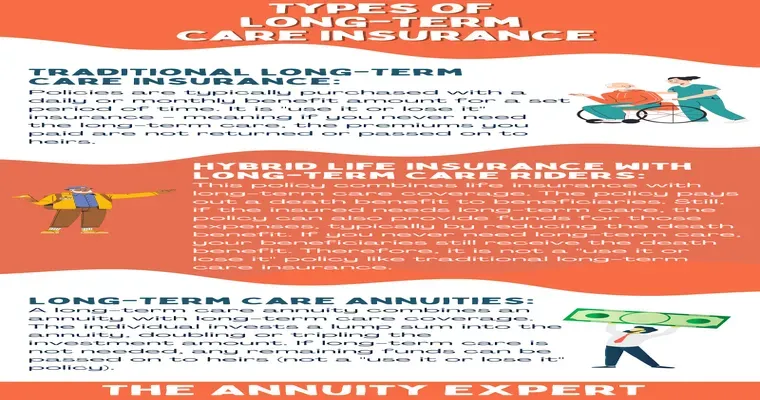

2. Whole Life Insurance

"Whole life insurance" is a permanent policy that offers coverage for the policyholder’s entire life, as long as the premiums are paid. This type of policy includes a cash value component that grows over time, providing a potential source of funds for emergencies or other needs. For seniors, whole life insurance can serve as a tool for estate planning, ensuring that beneficiaries receive a death benefit while also allowing for potential borrowing against the policy’s cash value. Although premiums are generally higher than term policies, the lifelong coverage and cash value accumulation can be beneficial for those who want to leave a financial legacy.

3. Guaranteed Issue Life Insurance

"Guaranteed issue life insurance" is designed for seniors who may have health issues that make it difficult to qualify for traditional policies. This type of insurance does not require a medical exam or health questions, making it accessible for individuals regardless of their health status. While the coverage amounts are typically lower and premiums can be higher, guaranteed issue policies ensure that seniors can obtain some level of life insurance protection. This option is especially useful for those looking to cover final expenses, such as funeral costs, without the burden of medical underwriting.

4. Final Expense Insurance

"Final expense insurance" is a specialized type of whole life insurance that is specifically created to cover end-of-life costs. This can include funeral expenses, medical bills, and other costs associated with passing. Final expense policies generally have lower face values, making them more affordable for seniors on a fixed income. These policies provide peace of mind, ensuring that loved ones will not be left with a financial burden during an already difficult time.

Conclusion

Selecting the right "life insurance option" is crucial for seniors looking to secure their financial future and provide for their loved ones. Whether you choose term life, whole life, guaranteed issue, or final expense insurance, understanding the unique benefits of each option will help you make an informed choice. Take the time to evaluate your needs and consult with a financial advisor or insurance professional to find the best solution for your situation. Remember, having the right life insurance can bring peace of mind and financial security to you and your family.