Navigating "Medicaid" regulations can be complex, especially when it comes to "life insurance" and beneficiaries. Families often find themselves in a dilemma when trying to ensure that their loved ones receive their rightful inheritance without jeopardizing "Medicaid" eligibility. This article explores how a mother can designate her grandson as a beneficiary without facing penalties from "Medicaid".

Understanding Medicaid Eligibility

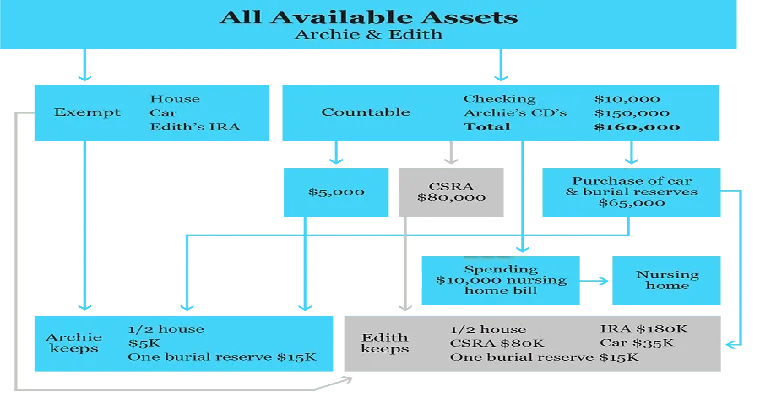

Medicaid is a government program designed to assist low-income individuals with healthcare costs. To qualify for Medicaid, applicants must meet specific income and asset limits. Any assets transferred or given away in the years leading up to a Medicaid application can lead to penalties, making it crucial to understand how "life insurance" can affect eligibility.

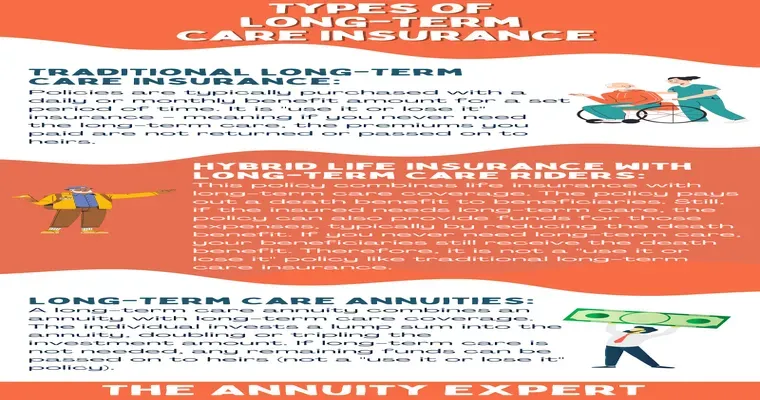

Life Insurance and Medicaid

When considering "life insurance", it is essential to know how it impacts Medicaid eligibility. If a mother wants to ensure her grandson is the beneficiary of her "life insurance policy", it is vital to understand the implications. The cash value of the policy may count as an asset, which could affect her eligibility for Medicaid benefits.

Gifting Strategies

One way a mother can ensure her grandson receives his due without jeopardizing her "Medicaid" eligibility is through strategic gifting. Here are some options:

1. "Irrevocable Life Insurance Trust (ILIT)": Establishing an ILIT can help. By placing the "life insurance" policy in an irrevocable trust, the mother can effectively remove the policy from her estate, making it exempt from Medicaid asset calculations. When she passes, the trust ensures that the proceeds go directly to her grandson.

2. "Direct Gifting": A mother can gift a limited amount of money to her grandson each year without triggering gift tax consequences. However, these gifts may still impact her Medicaid eligibility if they exceed the annual exclusion limit and are not structured properly.

3. "Spend Down": If a mother is nearing Medicaid eligibility, she can spend down her assets on allowable expenses, such as home improvements or medical expenses, which can help her qualify for Medicaid while still providing for her grandson.

Timing Matters

Timing is crucial when it comes to "Medicaid" and life insurance. The "look-back period" for Medicaid is typically five years, meaning any gifts made during this time may be scrutinized. Therefore, if a mother plans to gift her "life insurance" policy or its proceeds, she should consider doing so well in advance of applying for Medicaid.

Consult a Professional

Given the complexities surrounding "Medicaid" regulations and "life insurance" policies, it is highly advisable to consult with a financial advisor or an elder law attorney. These professionals can provide personalized advice and strategies to ensure that the mother can give her grandson his due without facing penalties.

Conclusion

In summary, while navigating the intersection of "Medicaid" and "life insurance" can be challenging, there are strategies available to help a mother provide for her grandson without jeopardizing her eligibility. By considering options such as an irrevocable trust, making direct gifts, or spending down assets wisely, she can achieve her goals. Always seek professional guidance to ensure compliance with Medicaid rules and to protect her family's financial future.