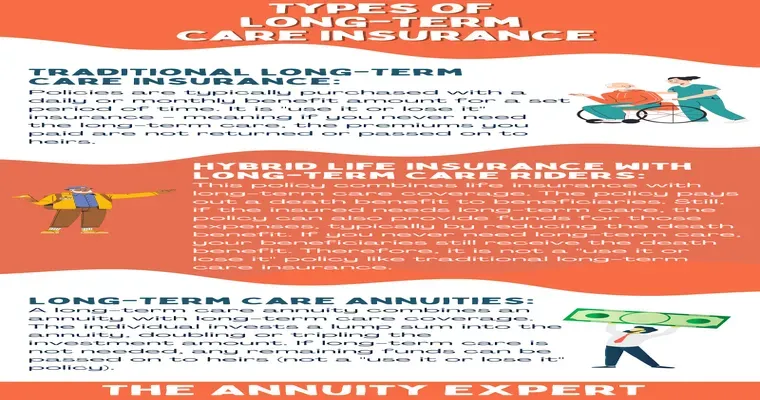

When parents are approaching the possibility of qualifying for "Medicaid", they often find themselves navigating complex financial waters. One of the most significant concerns is whether they can retain their "whole life policy" after undergoing a "spend down" to meet Medicaid eligibility requirements. Understanding the implications of the "cash value" associated with whole life insurance policies is crucial for families planning for long-term care.

Whole life insurance policies provide not only a death benefit but also a "cash value" component that accumulates over time. This cash value can serve as a vital asset for parents, particularly when other financial resources are limited. However, Medicaid has strict asset limits, and understanding the rules surrounding these policies is essential.

Understanding Medicaid's Asset Limits

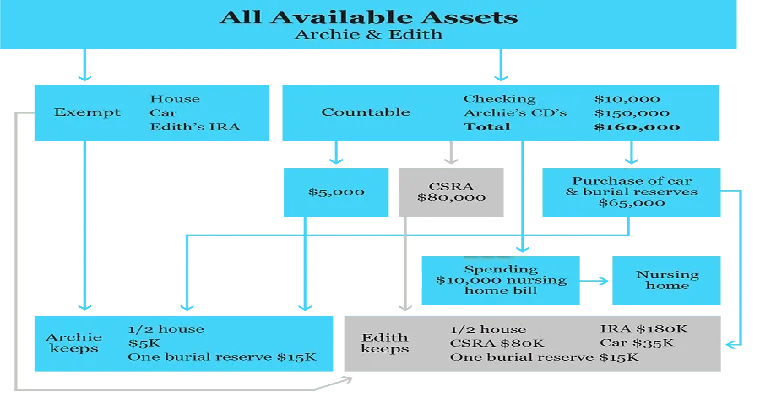

To qualify for Medicaid, individuals must meet specific income and asset limits that vary by state. For many parents, their whole life policy may represent their only remaining asset after the spend down phase. During this process, individuals may need to liquidate or spend their resources to fall below the asset threshold set by Medicaid.

The Role of Cash Value in Medicaid Eligibility

The "cash value" of a whole life policy is considered an asset by Medicaid. This means that if parents have a significant cash value in their policy, it could affect their eligibility for Medicaid. However, the good news is that not all cash value is treated equally under Medicaid regulations.

In many states, the cash value of a whole life policy is exempt up to a certain limit. For example, many states allow a cash value exemption of up to $1,500 or more, depending on the specific regulations in place. It is crucial for parents to check with their local Medicaid office to understand the current asset limits and exemptions applicable to their situation.

Spend Down Strategies for Whole Life Policies

If parents find themselves needing to spend down their assets to qualify for Medicaid, they may consider several strategies. One option is to take out a loan against the cash value of the whole life policy. This strategy allows them to access funds while preserving the policy itself. However, it is essential to remember that loans must be repaid, or they will reduce the death benefit available to beneficiaries.

Another approach is to fully surrender the policy, which would provide immediate cash but may disqualify them from Medicaid eligibility based on the sudden increase in available assets. Parents should carefully weigh this option and consult with a financial advisor or elder law attorney to avoid jeopardizing their Medicaid eligibility.

Retaining the Whole Life Policy After Qualifying for Medicaid

In many cases, parents can retain their whole life policy after qualifying for Medicaid, as long as they navigate the complexities of asset limits and spend down requirements appropriately. If the cash value of the policy is below the exempt limit set by Medicaid, parents can maintain the policy without risking their eligibility for benefits.

Additionally, it is important to note that Medicaid rules can vary significantly from one state to another, so verifying specific state regulations is key. Parents should also consider the potential benefits of keeping the policy, such as the death benefit for beneficiaries and any remaining cash value for emergencies.

Conclusion

In conclusion, while the "whole life policy cash value" may be the only significant asset that parents have as they approach Medicaid eligibility, understanding how to navigate the spend down process is crucial. By leveraging exemptions and considering strategic options, parents can retain their whole life policy while qualifying for Medicaid. It is always advisable to consult with professionals knowledgeable in Medicaid regulations to ensure that families make informed decisions about their financial futures.