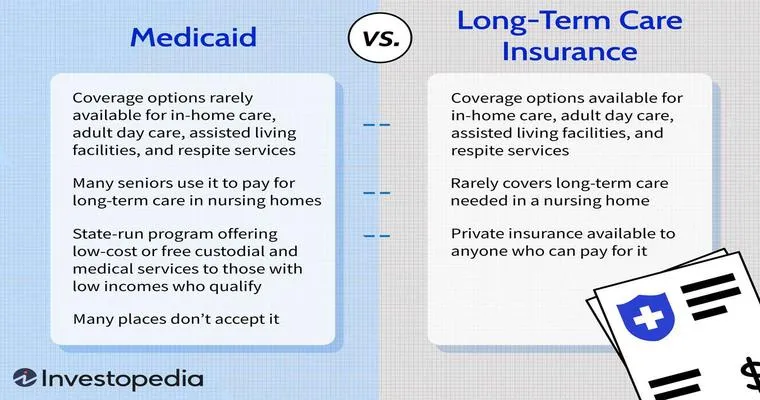

When planning for long-term care, understanding the "Medicaid spend-down" process is essential for individuals looking to qualify for benefits. A "prepaid funeral plan" can be a strategic and compassionate choice within this framework. By incorporating a prepaid funeral plan into your financial strategy, you can ensure that your end-of-life arrangements are taken care of while also assisting in meeting Medicaid eligibility requirements.

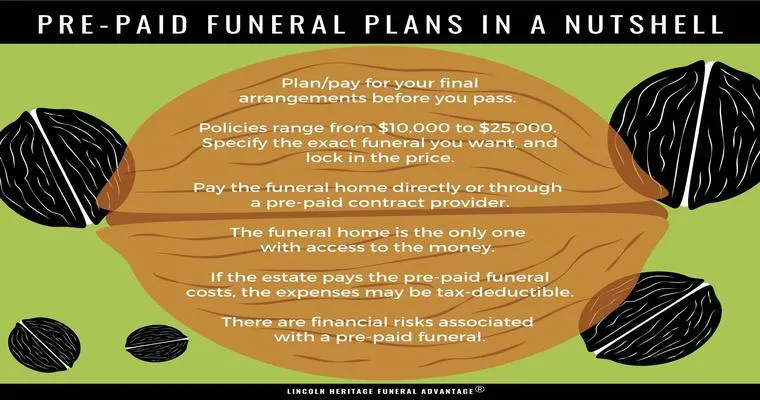

Medicaid is designed to assist those with limited financial resources, and the spend-down process allows individuals to reduce their countable assets to qualify for assistance. When considering assets, it is essential to know which items are considered non-countable by Medicaid. One of the key considerations is whether a prepaid funeral plan is exempt from being counted as an asset. In many states, a properly funded "prepaid funeral plan" is considered an exempt asset, meaning it does not impact your eligibility for Medicaid services.

The benefits of integrating a prepaid funeral plan into your Medicaid spend-down strategy are twofold. First, it provides peace of mind knowing that your funeral expenses are covered, alleviating the financial burden on your family during a difficult time. Second, it effectively reduces your countable assets, which can help you meet the Medicaid eligibility threshold.

When selecting a prepaid funeral plan, it is crucial to ensure that the plan is compliant with Medicaid regulations. This means choosing a plan that is irrevocable, meaning the funds are designated solely for your funeral expenses and cannot be withdrawn for other purposes. By doing so, you protect your assets from being counted against you while also securing your final wishes.

Additionally, it is advisable to consult with a financial planner or an elder law attorney who specializes in Medicaid planning. They can provide valuable insights into how a prepaid funeral plan fits into your overall financial strategy and ensure that you adhere to all legal requirements. This professional guidance can help you navigate the complexities of Medicaid regulations and make informed decisions that align with your financial goals.

In conclusion, incorporating a "prepaid funeral plan" into your "Medicaid spend-down" strategy is a prudent decision that serves multiple purposes. It not only assists you in qualifying for Medicaid by reducing your countable assets but also ensures that your funeral arrangements are handled according to your wishes. By planning ahead and seeking professional advice, you can secure both your financial future and the comfort of your loved ones during a challenging time.