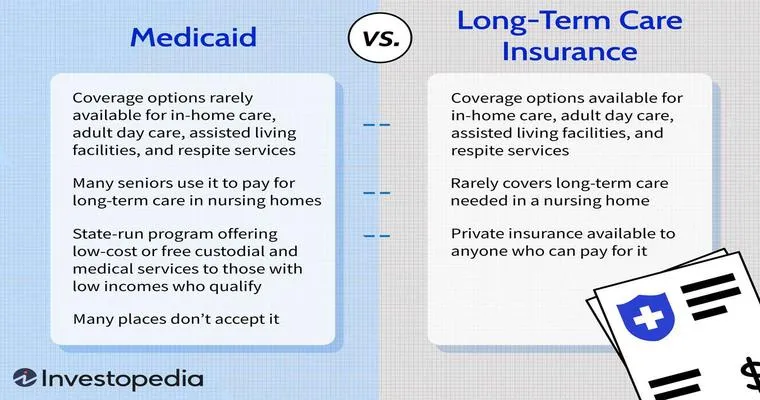

Navigating the complexities of "Medicaid", "nursing home" care, and "personal finances" can be daunting, especially when it involves a loved one like your mom. If your mom is currently living in a nursing home and has recently qualified for Medicaid, understanding the rules surrounding her finances, including the allowance of "savings", is crucial. With 25,000 in savings, you might be wondering, "Can I buy her things?" The answer is nuanced, and it's important to consider how these purchases might affect her Medicaid status and overall financial situation.

Understanding Medicaid and Asset Limits

Medicaid is a government program that helps cover healthcare costs for low-income individuals, including those in nursing homes. Each state has its own set of rules regarding eligibility, but generally, Medicaid has strict asset limits. For an individual, this usually means having no more than 2,000 in countable assets. However, your mom's 25,000 in savings is acceptable under certain conditions, such as being considered a protected asset or being used for specific expenses.

Can You Buy Her Things?

The short answer is yes, you can buy your mom things, but there are important considerations to keep in mind. Here are the key points to help you navigate this situation:

1. "Exempt Items and Expenses"

You can purchase items or services that are considered exempt from Medicaid's asset limits. This includes:

"Personal items": Clothing, toiletries, and other personal care items.

"Medical supplies": Items that may enhance her well-being, such as eyeglasses or hearing aids.

"Quality of life enhancements": Items that improve her quality of life, such as a comfortable chair or a television.

2. "Gifts and Cash Transfers"

While you may be tempted to gift her a portion of her savings, it's crucial to understand that Medicaid has a "look-back period". This period typically spans five years during which Medicaid reviews asset transfers. If your mom gives away large sums of money or valuable items, it may affect her eligibility for Medicaid benefits. It's advisable to consult with a Medicaid planner or elder law attorney before making any significant financial decisions.

3. "Using Funds for Care"

If you are considering using her savings for care that is not covered by Medicaid, such as a private caregiver or specific therapies, this is generally acceptable. Ensure that any expenses align with Medicaid's guidelines to avoid jeopardizing her benefits.

4. "Consult with a Professional"

Given the complexities of Medicaid regulations, it is recommended to seek advice from a professional who specializes in elder law or financial planning for seniors. They can provide tailored advice based on your mom's situation and help you make informed decisions that protect her assets and well-being.

Conclusion

In conclusion, while you can buy your mom things while she is living in a nursing home and on Medicaid, it is essential to proceed with caution. Understanding what constitutes exempt items and the implications of financial gifts is crucial to maintaining her eligibility for benefits. Always consider consulting with an expert to navigate these waters effectively, ensuring that your mom's needs are met without jeopardizing her financial security. Making informed choices will not only improve her quality of life but also provide peace of mind for both of you during this challenging time.