When faced with the challenges of financing assisted living, many families find themselves exploring various options, including the "liquidation of annuities". In my mom's case, she had to liquidate her "annuity" to cover the costs of her "assisted living facility". This decision, while necessary, has raised concerns about the potential "income tax implications" associated with the withdrawal. Understanding these implications is crucial for anyone in a similar situation.

Annuities are financial products designed to provide a steady income stream, typically during retirement. However, when the need arises for long-term care and support, such as moving into an assisted living facility, withdrawing funds from an annuity can become essential. Unfortunately, this action can trigger tax consequences that many individuals may not be fully aware of.

When you withdraw funds from an annuity, the "income tax" you may owe depends on whether your annuity is qualified or non-qualified. Qualified annuities are funded with pre-tax dollars, while non-qualified annuities are funded with after-tax dollars. In the case of non-qualified annuities, withdrawals are generally taxed on the earnings portion only, which can lead to a higher-than-expected tax bill.

For individuals like my mom, who are liquidating their annuities to pay for assisted living, it is vital to consult a tax professional. They can provide clarity on how much tax will be owed and if there are any strategies to minimize the tax burden. For instance, if the annuity has been held for a long time, the earnings may be substantial, leading to a significant tax hit upon liquidation.

Additionally, there may be options such as "partial withdrawals" or "surrendering" the annuity that could impact tax implications differently. A tax advisor can help determine the most tax-efficient method for accessing the funds needed for assisted living expenses.

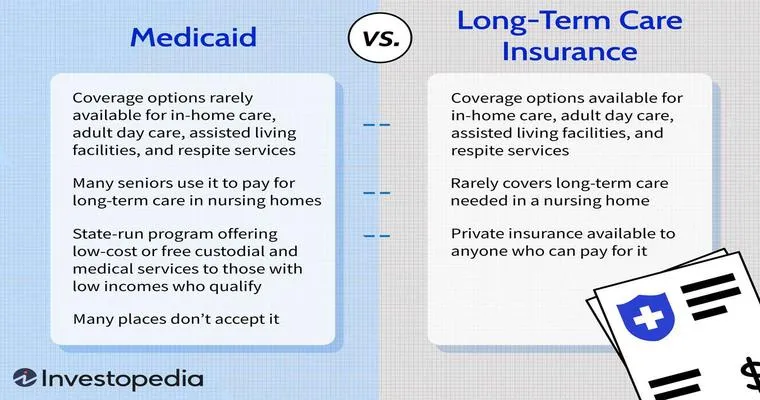

Moreover, it is essential to consider other financial resources and "government assistance programs" that might be available to help cover the costs of assisted living. These can sometimes alleviate the need to liquidate an annuity altogether, thus reducing the associated tax burden.

In conclusion, while liquidating an annuity to pay for an assisted living facility may be necessary, understanding the "income tax" implications is crucial. By consulting with a financial advisor or tax professional, families can make informed decisions that safeguard their financial well-being while ensuring their loved ones receive the care they need. It's essential to navigate these waters carefully to minimize tax liabilities and maximize the funds available for care.