Navigating the complexities of "long-term care (LTC) insurance" can be challenging, especially when dealing with "assisted living facilities (ALFs)". Many families expect that their LTC insurance will cover expenses incurred at an ALF, but unfortunately, this is not always the case. Understanding why an ALF may not work with a specific LTC insurance company is crucial for families seeking reimbursement for their loved ones' care expenses.

One primary reason ALFs may not collaborate with certain LTC insurance companies is due to "contractual agreements". Each insurance company has its own set of requirements and reimbursement policies, which may not align with the operational policies of the ALF. As a result, families might find themselves in a difficult position, having to pay out-of-pocket for services that they expected to be covered.

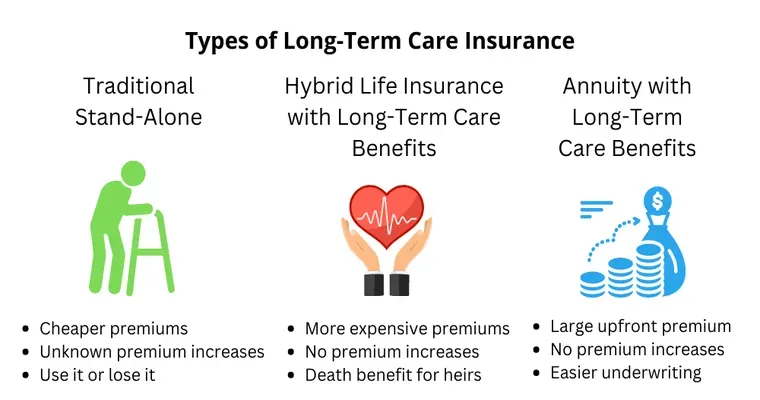

Additionally, the "benefit structure" of LTC insurance plans can vary greatly. Some policies may only cover specific types of care or services, while others may impose limits on the amount reimbursed. If an ALF does not provide the services outlined in the insurance policy, families could be left without any financial support for their loved ones' care. It is essential for families to thoroughly review their LTC insurance policy to understand what is covered and what is not.

Furthermore, the "licensing and certification" of ALFs can also play a significant role. Not all assisted living facilities are certified to provide the level of care that LTC insurance policies require. If an ALF does not meet these standards, it may not be considered an eligible provider by the insurance company, leading to denied claims for reimbursement.

Families should also be aware of the "claims process" involved in obtaining reimbursement. Even if an ALF does accept a particular LTC insurance plan, the process for filing claims can be cumbersome and time-consuming. Documentation requirements, deadlines, and communication with both the ALF and the insurance company can complicate the reimbursement process further.

To avoid these issues, families should proactively communicate with both the LTC insurance company and the ALF before making any decisions. Asking about "coverage options", reimbursement processes, and potential out-of-pocket expenses can help clarify expectations and ensure that families are prepared for the financial responsibilities of long-term care.

In conclusion, understanding why an ALF may not work with a specific LTC insurance company is essential for families looking to get reimbursed for their loved ones' care expenses. By being informed about contractual agreements, benefit structures, licensing requirements, and the claims process, families can make better choices regarding long-term care. It is always advisable to conduct thorough research and seek guidance from financial advisors or eldercare experts to navigate the complexities of LTC insurance and assisted living facilities.