When considering the future of your financial security, many individuals ponder whether "long term care insurance" is a wise investment. With the increasing costs of healthcare and the likelihood of needing assistance as we age, understanding the benefits and drawbacks of this type of insurance is crucial. This article explores the implications of purchasing long term care insurance, helping you determine if it is a good idea for your unique circumstances.

One of the primary reasons people consider "long term care insurance" is the rising cost of care services. As we age, the possibility of requiring assistance with daily activities increases, whether due to chronic illness, disability, or cognitive decline. According to various studies, the average cost of nursing home care can reach thousands of dollars per month, making it financially challenging for many families. Long term care insurance can help mitigate these costs, providing peace of mind that your care needs will be met without depleting your savings.

Another important factor to consider is the "age at which you purchase long term care insurance". The ideal time to buy this insurance is often in your 50s or early 60s, as premiums tend to be lower at this age. Additionally, health issues that may arise later in life could prevent you from qualifying for coverage or lead to higher premiums. By purchasing insurance early, you can secure your financial future and ensure coverage when you need it most.

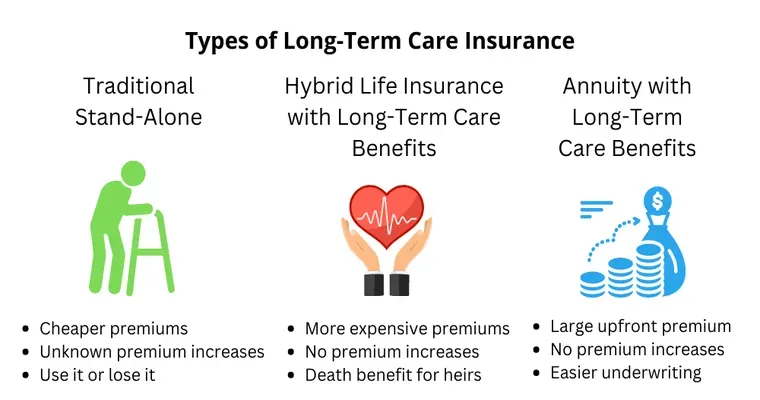

However, long term care insurance is not without its downsides. The cost of premiums can be significant, and they may increase over time. Some individuals may find themselves paying for coverage they never use, which can lead to frustration and financial strain. It is essential to weigh the potential benefits against the costs and consider your personal circumstances, including your health history and family dynamics.

When deciding if long term care insurance is a good idea, consider your family’s history with long-term health issues. If you have a family history of conditions that require extensive care, you may be more inclined to invest in this type of insurance. On the other hand, if you are in excellent health and have a strong support system in place, you might feel comfortable forgoing coverage.

Another option to explore is the availability of "state programs and Medicaid". In some cases, state-funded programs may provide assistance for long-term care services, depending on your income and asset levels. Understanding these options can help you make an informed decision about whether long term care insurance is necessary for you.

In conclusion, determining whether long term care insurance is a good idea requires careful consideration of your financial situation, health history, and family needs. While it can provide security and peace of mind in the face of rising healthcare costs, it is essential to evaluate the premiums and potential benefits. Consulting with a financial advisor can also provide insight tailored to your specific circumstances, helping you make the best decision for your future. Ultimately, being proactive about your long-term care planning can lead to better outcomes and less stress as you age.