As a caregiver, navigating the complexities of taxes can be challenging, especially when it comes to understanding "deductions", "credits", and "reporting income". Whether you are providing care for a family member or working in a professional capacity, it's crucial to be aware of the tax implications associated with your caregiving role. This article will address some of the most common tax questions caregivers ask, providing clarity and guidance to make the tax season less daunting.

One of the first questions caregivers often have is whether they can claim their caregiving expenses on their taxes. The answer largely depends on the nature of the caregiving provided. If you are a family caregiver, you may not be able to claim most expenses directly. However, if you are providing care as a paid professional, you can often deduct specific expenses related to your caregiving work. This may include costs for supplies, mileage for travel to and from the care recipient’s home, and other necessary expenditures incurred while performing your duties.

Another frequent inquiry revolves around the possibility of claiming the care recipient as a dependent. To qualify as a dependent, the individual must meet certain criteria, including income limits and relationship status. If you are caring for a parent or other relative, and they meet these requirements, you may be able to claim them on your tax return. This could result in additional tax benefits, such as the "Dependent Care Credit".

Caregivers also commonly ask about the "Dependent Care Credit" itself. This credit allows you to claim a percentage of the expenses incurred for the care of a qualifying individual while you work or look for work. To be eligible, the care recipient must be a child under the age of 13 or a dependent who is physically or mentally incapable of self-care. Understanding how to maximize this credit can lead to significant savings on your taxes.

Additionally, many caregivers are curious about how to report their income, particularly if they are self-employed or working as independent contractors. When reporting income as a caregiver, it is essential to keep meticulous records of your earnings and expenses. If you are self-employed, you will typically report your income on Schedule C of your tax return. Moreover, it is crucial to understand your obligation regarding "self-employment taxes" and ensure that you are setting aside enough to cover these liabilities.

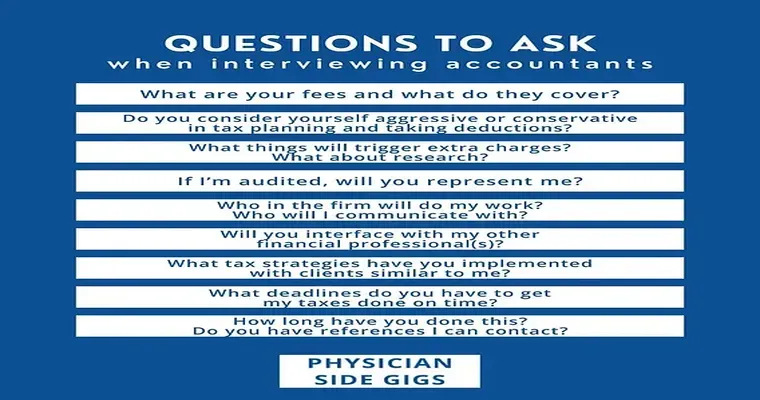

Finally, caregivers often seek information on resources available to help them during tax season. The IRS offers various tools and publications that can assist caregivers in understanding their responsibilities and rights. Furthermore, consulting a tax professional with experience in caregiving-related tax issues can provide personalized advice tailored to your specific situation.

In conclusion, understanding the tax implications of caregiving can help alleviate financial stress and ensure compliance with tax regulations. By familiarizing yourself with "deductions", "credits", and the proper reporting of income, you can navigate the tax landscape more effectively. Remember, seeking professional guidance can also be invaluable in optimizing your tax situation. As a caregiver, your dedication to providing care is commendable, and being informed about your tax responsibilities is a vital part of that commitment.